- The US economy added 528,000 jobs in July.

- Thirty thousand six hundred people lost jobs in Canada.

- Investors expect a rise in US core inflation.

The weekly USD/CAD forecast is bullish as the upbeat US jobs report gives the Federal Reserve room to be more aggressive.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Ups and downs of USD/CAD

The pair closed the week higher as the dollar strengthened and the Loonie weakened. The Labor Department’s employment report revealed that while wage inflation remained high and the participation rate dipped lower, the U.S. economy added 528,000 jobs in July, more than double the 250,000 anticipated.

After a year of expansion, Canada’s economy unexpectedly shed jobs for the second consecutive month in July. Still, economists predicted that the Bank of Canada would continue to raise interest rates to combat inflation.

On Friday, Statistics Canada revealed that 30,600 jobs were lost, but the unemployment rate remained at a record-low 4.9 percent.

The results indicated a second month in a row of losses. As the COVID-19 recovery took root between May 2021 and May 2022, the economy added 1.06 million jobs.

According to Reuters’ survey of analysts, 20,000 more jobs would have been created, and the unemployment rate would have risen to 5.0 percent.

To combat inflation, the BOC startled markets last month by increasing its primary interest rate by 100 basis points. It later announced that additional increases would be required.

Although the July numbers were disappointing, Derek Holt, vice president of capital markets economics at Scotiabank, projected that Canada’s central bank would continue raising rates.

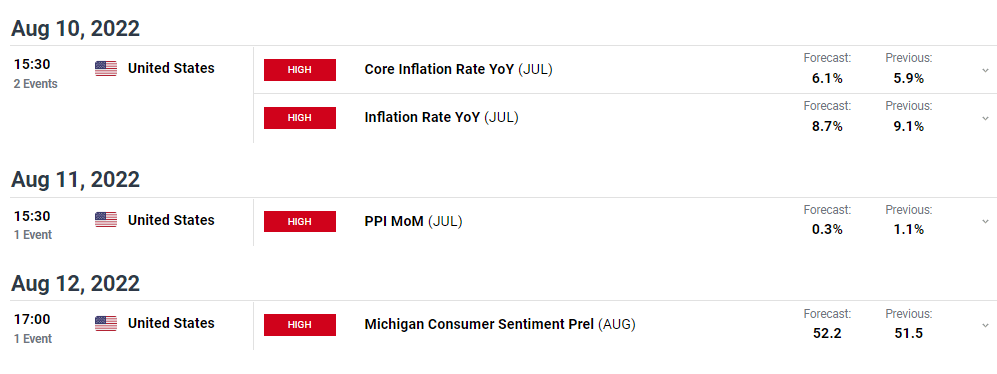

Next week’s key events for USD/CAD

Investors will pay attention to the US inflation report, which is expected to give more insight into the Fed’s next move. The core inflation is expected to rise while the inflation rate year-on-year is expected to drop. If it rises instead, the Federal Reserve will respond accordingly.

-Are you looking for the best CFD broker? Check our detailed guide-

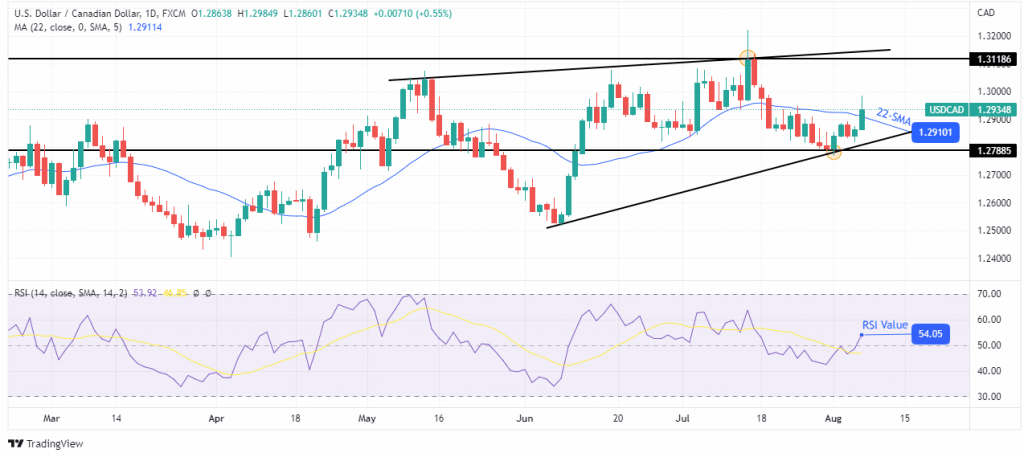

USD/CAD weekly technical forecast: Bullish shift above the 22-SMA

The daily chart shows USD/CAD pushing off a strong support level at 1.27885. The price broke and closed above the 22-SMA, showing control has gone to the bulls. The RSI is trading above 50, also favoring bullish momentum. At this point, the price might rally in the coming week to retest key resistance at 1.31186.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.