- USD/CHF crossed 1.00 with strength on Thursday and clocked a two-month high in Asia.

- The risk reversals hit 7.5-week high, indicating falling demand for CHF calls (bullish bets).

The USD/CHF closed above 1.00 on Thursday – its first daily close above the psychological mark since May 17. Further, the currency pair rose to 1.00346 in Asian session today – the highest level since May 15.

The bullish move is accompanied by a falling demand for the CHF call options, risk reversals indicate.

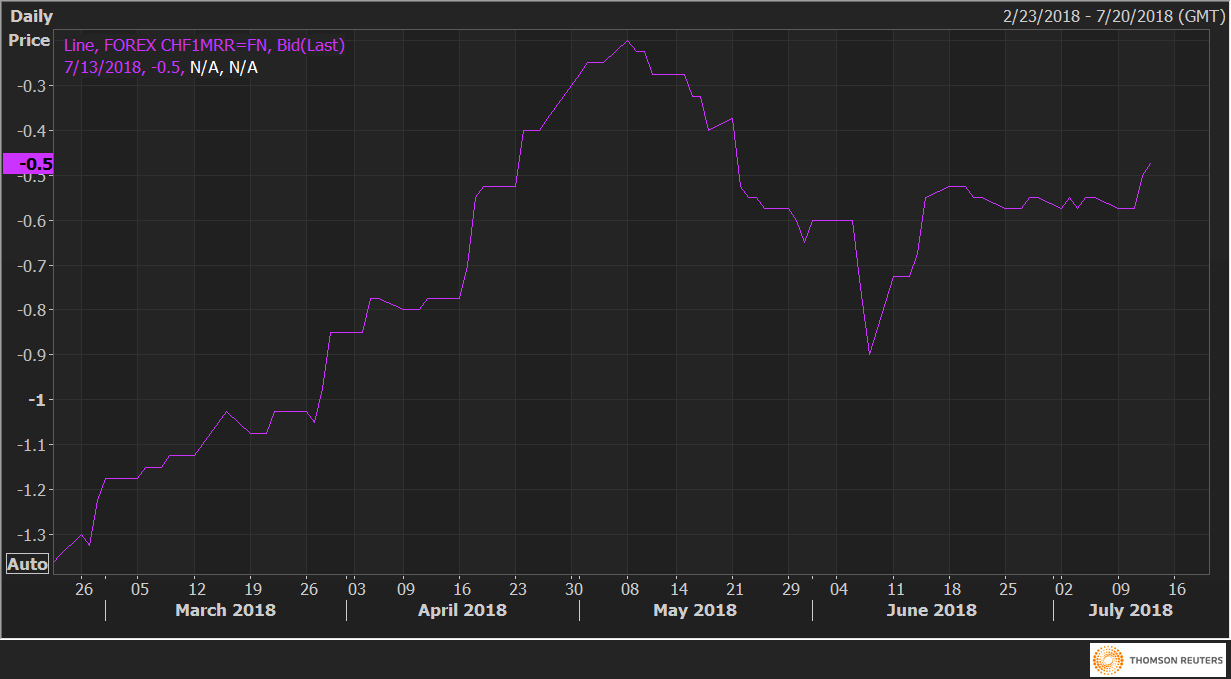

The USD/CHF one month 25 delta risk reversals (CHF1MRR) are being paid at 0.5 CHF calls vs 0.6 CHF calls seen on July 11 (weekly low) and 0.9 CHF calls seen on June 8.

The drop in the implied volatility premium (drop in demand) for CHF calls indicates the options market is biased to the upside and adds credence to USD/CHF’s strong break above 1.00.

CHF1MRR