- USD/CHF carries recovery moves from late-Tuesday.

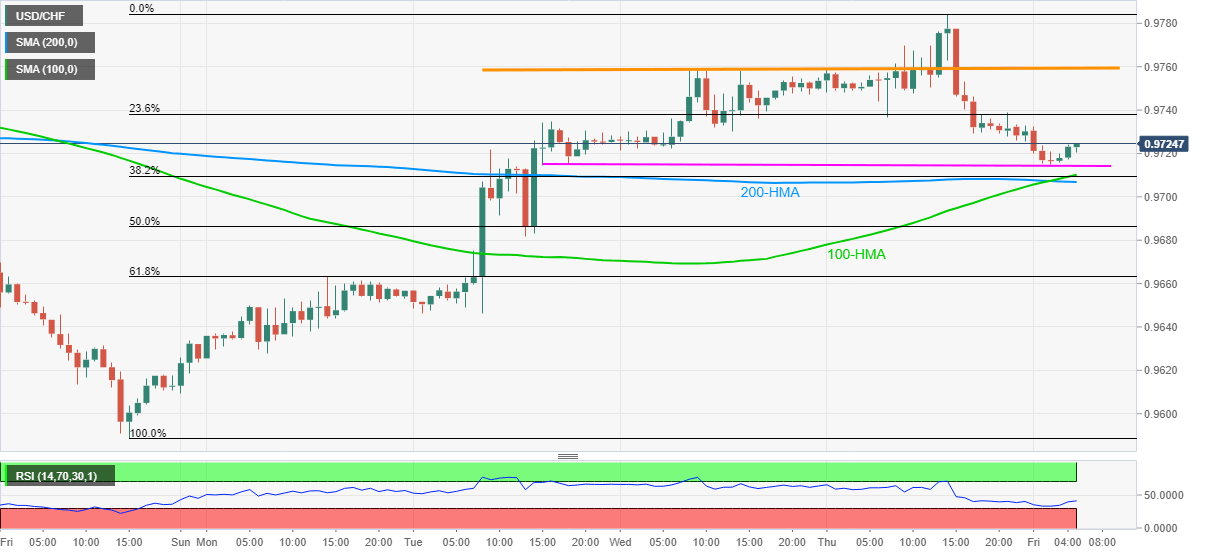

- A confluence of 100/200-HMAs and 38.2% Fibonacci retracement offer strong support.

- The short-term horizontal resistance guards immediate upside.

USD/CHF trades near 0.9720, down 0.10% on a day while heading into the European session on Friday.

In doing so, the pair carries its bounce off three-day-old horizontal support.

As a result, 23.6% Fibonacci retracement level of the pair’s one-week-old rise, around 0.9740 lures the buyers.

However, a horizontal line from Wednesday, around 0.9760 holds the gate for the pair’s further run-up towards the monthly high of 0.9784.

On the downside, the aforementioned horizontal support around 0.9715 acts as an immediate challenge to the sellers.

Following that, a confluence of 100/200-HMAs and 38.2% Fibonacci retracement around 0.9710/05 becomes a tough nut to crack for them.

USD/CHF hourly chart

Trend: Further recovery expected