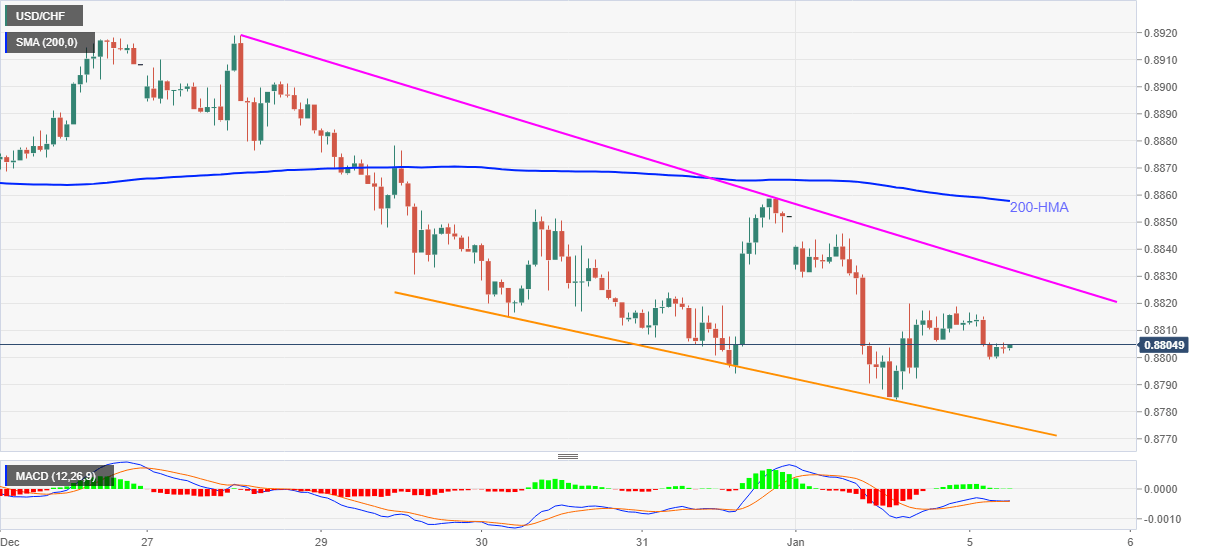

- USD/CHF fails to keep 0.8800, MACD loses recently gained bullish bias.

- Descending trend line from December 28, 200-HMA guard immediate upside.

- Sellers target the early 2014 lows on their way to 2015 bottom.

USD/CHF drops to 0.8801, down 0.10% intraday, while heading into Tuesday’s European session. The quote bounced off the multi-month low the previous day but failed to cross 0.8819 during the corrective pullback.

Not only the failures to stay past-0.8800 but weakening MACD signals join sustained trading below 200-HMA and a short-term resistance line also favor the USD/CHF sellers.

As a result, the pair sellers can keep the recent low of 0.8784 as an immediate target on their radar. However, a falling trend line from December 30, at 0.8773 now, could restrict further weakness.

It should, however, be noted that major bears are targeting the year 2014 bottom surrounding 0.8700 while also dreaming to visit the 2015 low of 0.8365.

On the contrary, an immediate falling trend line near 0.8835 precedes the 200-HMA level of 0.8857 to challenge the USD/CHF buyers even if they manage to keep the 0.8800 threshold.

Overall, the bears are less likely to relinquish controls unless witnessing an upside break beyond November’s low of 0.8982.

USD/CHF hourly chart

Trend: Bearish