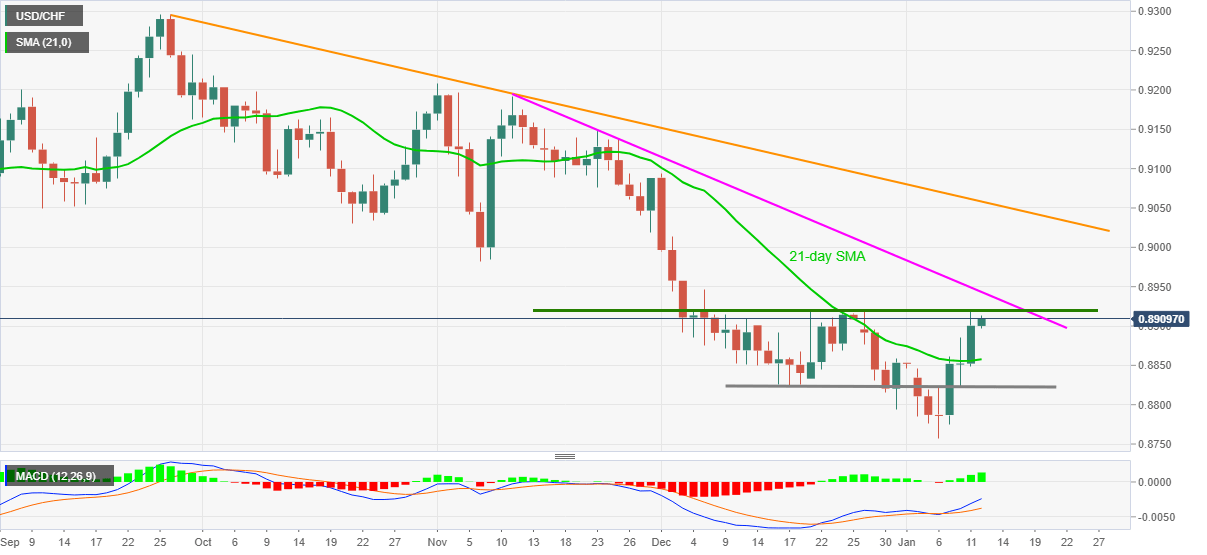

- USD/CHF stays mildly bid after successfully crossing 21-day SMA.

- Five-week-old horizontal line guards immediate upside, 0.8821-23 adds to the downside filters.

USD/CHF gains 0.12% intraday while picking up the bids around 0.8910 during early Tuesday. In doing so, the quote extends the upside break of 21-day SMA, portrayed the previous day, while also battling a short-term horizontal area comprising multiple highs since December 04.

Although sustained break of short-term key SMA and bullish MACD favors USD/CHF buyers, the aforementioned horizontal resistance around 0.8821-23 guards immediate upside.

Even if the quote manages to cross 0.8823, a downward sloping trend line from November 11, 2020, at 0.8945 now, probes the north-run.

Additionally, the November low of 0.8982, the 0.9000 round-figure and a descending resistance line stretched from late-September, currently around 0.9060, will probe the USD/CHF bulls past-0.8945.

Meanwhile, a 21-day SMA level of 0.8857 can probe immediate USD/CHF declines if it drops below the 0.8900 threshold.

Also acting as the key support, before the multi-month low of 0.8757, is the area around 0.8822-20 that comprising multiple levels marked since December 15.

USD/CHF daily chart

Trend: Pullback expected