- USD/CHF posts the biggest gains in four days, buyers attack intraday high.

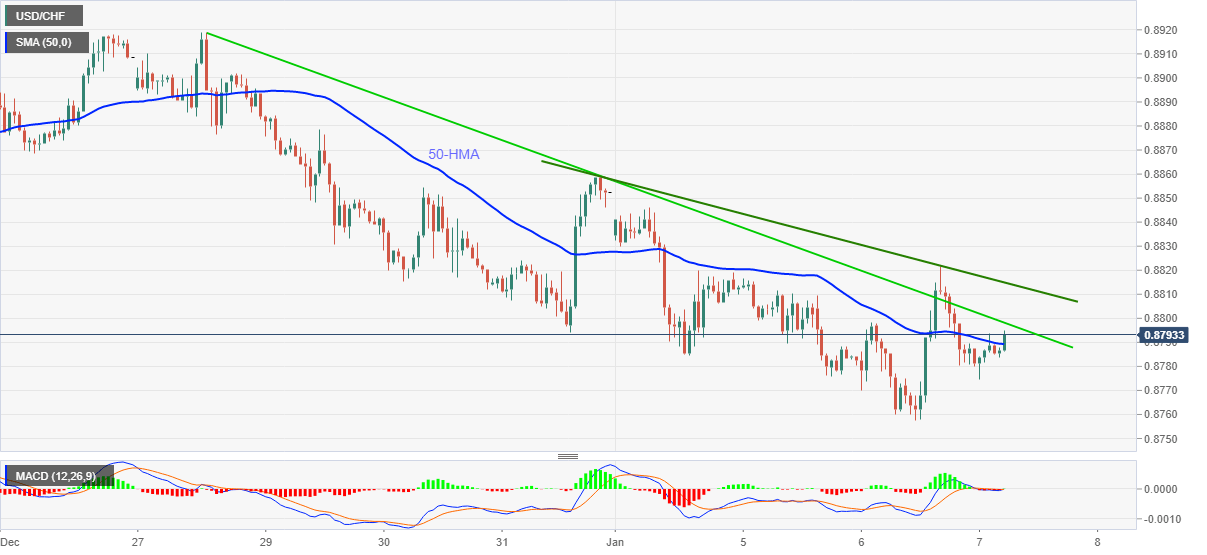

- Sustained break of 50-HMA aims for short-term resistance lines.

- Bears await fresh multi-month low before targeting the 0.8700 threshold.

USD/CHF rises to the day’s high of 0.8794, up 0.09% intraday, ahead of Thursday’s European session. The pair buyers cheer an upside break of 50-HMA to portray the biggest gains in the last four days.

Even so, a downward sloping trend line from December 28 and another one the last Thursday, respectively near 0.8798 and 0.8815, offer imminent challenges to the buying momentum.

In a case where the USD/CHF buyers cross 0.8815, the late-December tops near 0.8920 and November’s low close to 0.8980 will be in the spotlight.

Meanwhile, 0.8770 and the recent low, also the lowest since January 2015, of 0.8757 will be the key support to limit the pair’s short-term downside.

It should, however, be noted that any further weakness past-0.8757 will not refrain from challenging the early 2014 bottom surrounding the 0.8700 round-figure.

Overall, USD/CHF is likely to consolidate some gains but the bearish momentum can’t be ruled out unless crossing November’s low.

USD/CHF hourly chart

Trend: Pullback expected