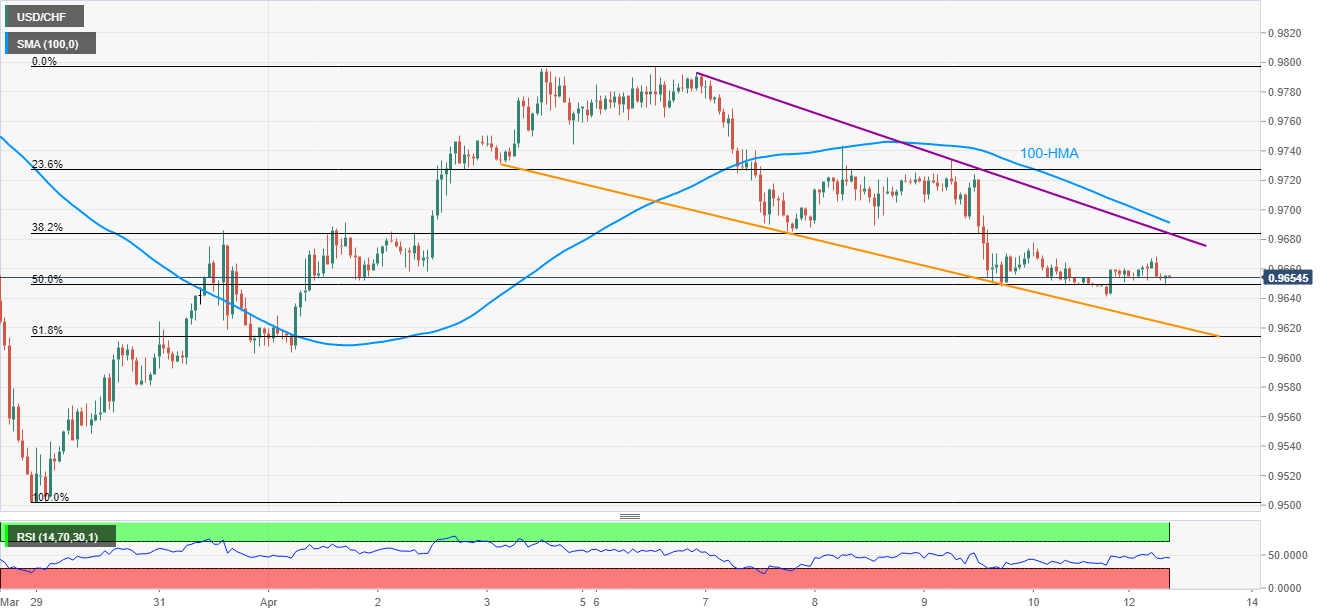

- USD/CHF extends gradual declines from the monthly top marked the last-Monday.

- A descending trend line support, 61.8% Fibonacci retracement may offer intermediate rests during the downside.

- 0.9745/50 can act as a buffer resistance beyond 100-HMA.

USD/CHF remains under pressure while taking rounds to 0.9655, down 0.05% on a daily, amid the early trading session on Monday.

The pair currently tests 50% Fibonacci retracement of its upside from March 27 to April 06. However, a descending trend line from last-Monday, at 0.9685, followed by a 100-HMA level of 0.9693, restricts the pair’s recovery moves.

Should there be a clear upside past-0.9693, the pair can cross 0.9700 mark to aim for 0.9745/50 area comprising multiple lows/highs marked during early-April.

Meanwhile, a downward sloping trend line from April 03, around 0.9620 now, can restrict the pair’s immediate declines ahead of 61.8% Fibonacci retracement level of 0.9615.

It’s worth mentioning that the pair’s declines below 0.9615 will need validation from 0.9600 round-figure before targeting 0.9550 and March 29 low near 0.9500.

USD/CHF hourly chart

Trend: Bearish