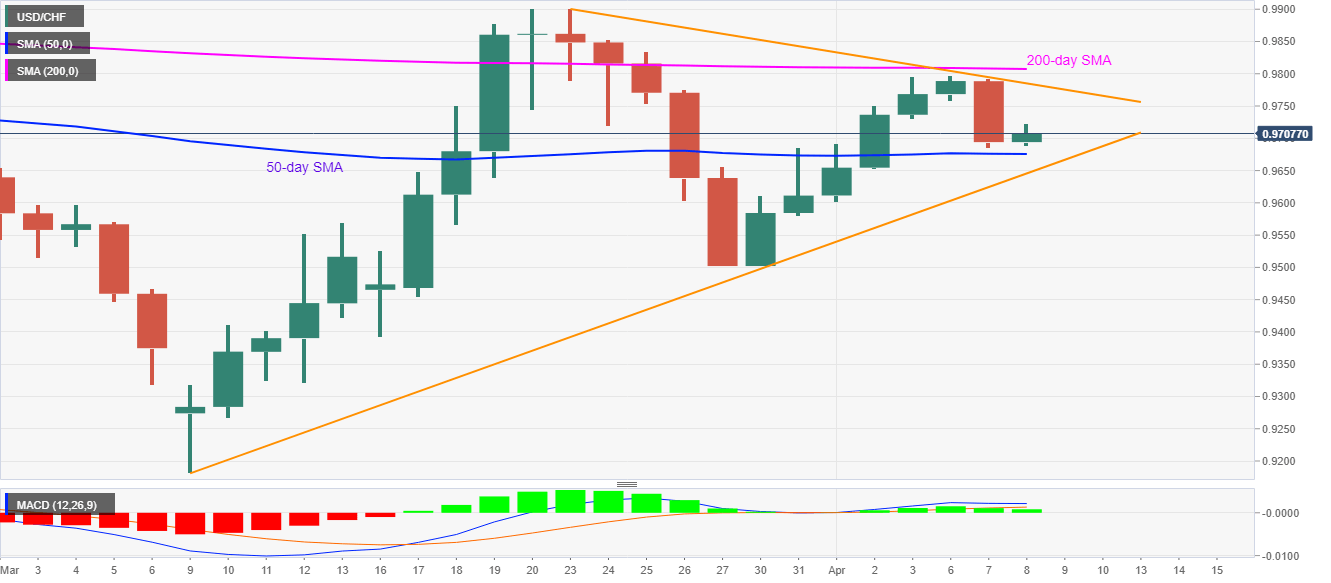

- USD/CHF registers mild gains following the latest pullback.

- A two-week-old falling trend line, 200-day SMA guard the pair’s near-term upside.

- The monthly support line adds to the downside challenges to the bears below 50-day SMA.

While extending its recovery moves from 50-day SMA, USD/CHF rises to 0.9710, up 0.15%, as the European traders ready the bell for Wednesday.

The pair currently advances towards a short-term falling trend line resistance, at 0.9785, a break of which could question a 200-day SMA level around 0.9810.

However, a successful run-up past-0.9810 enables the bulls to aim for the previous month’s top nearing 0.9900.

On the downside, an ascending trend line from March 09, around 0.9645, will stop the bears below 50-day SMA, presently near 0.9675.

In a case where the USD/CHF prices slip below 0.9645, the previous week’s low around 0.9500 will be on the sellers’ radar.

USD/CHF daily chart

Trend: Sideways