- The USD/CHF dropped as the DXY has slipped lower, but the bias remains bullish.

- A strong bullish pattern around the current support levels could bring new buying opportunities.

- The current retreat was somehow expected after the most recent rally.

The USD/CHF price analysis suggests bearish action for now. However, the FOMC projections and clues for Fed tapering may turn the upside.

-Are you looking for the best CFD broker? Check our detailed guide-

The USD/CHF pair plunged in the recent hours, trading around 0.9225, far below today’s highs of 0.9250. The pressure is high as the Dollar Index failed to resume its rally. From the technical point of view, a temporary decline was expected in the USD/CHF pair after registering an amazing rally.

Still, the current retreat could end anytime as the Dollar Index maintains a bullish bias despite a temporary decline. However, DXY’s deeper drop may force the pair to approach the new lows in the short term.

As you already know, the FOMC meeting is the key market mover of the week, due today. You should be careful around this high-impact event, as anything can happen. The Federal Reserve is expected to keep its monetary policy unchanged in the September meeting. So, the Federal Funds Rate should remain at 0.25%. The FOMC Economic Projections, FOMC Statement, and the FOMC Press Conference may quickly move the USD/CHF in either direction. A dovish hint could penalize the USD, resulting in losing significant ground versus all its rivals. On the other hand, a neutral or a hawkish tone may help the greenback to rise.

USD/CHF price technical analysis: Key support levels

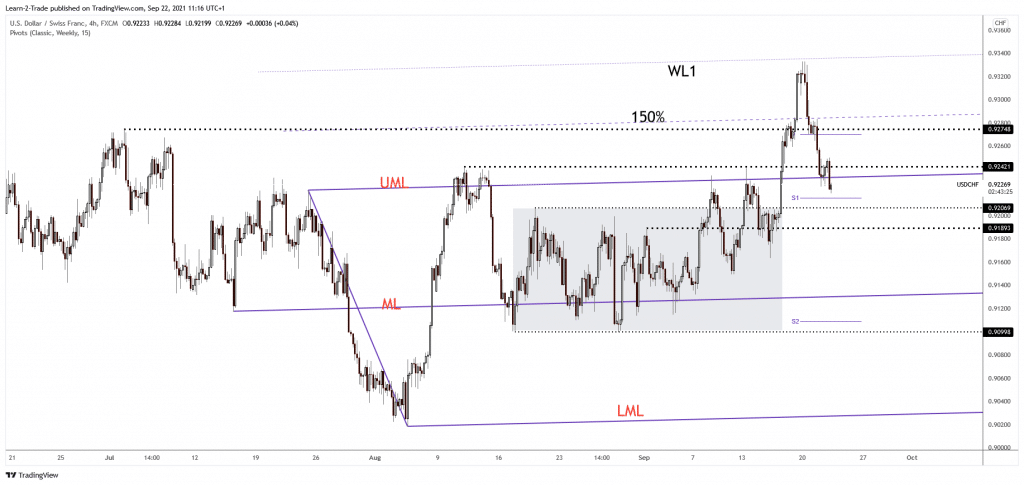

The USD/CHF price dropped below the ascending pitchfork’s upper median line (UML), and under 0.9242, former resistance turned into support. The next downside target is seen at the 0.9215 weekly S1.

-Are you looking for forex robots? Check our detailed guide-

Also, the 0.9206 level is seen as support as well. So, after this amazing sell-off, the pair could develop a rebound in the short term. That’s why we may search for new long opportunities after this downside movement, the corrective phase.

Personally, I’ll wait for a strong bullish pattern before jumping into a long position. The pressure is high, but the outlook is still bullish despite the current retreat. Coming back and stabilizing above the 0.9242 may announce a strong swing higher. A temporary consolidation here could bring fresh bullish opportunities in the USD/CHF pair.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.