- The USD/CHF pair is strongly bullish, and it could hit new upside obstacles soon.

- Better than expected US retail sales data boosted the Greenback.

- A minor retreat after the current rally could help us to catch new upside movements.

The USD/CHF price rallies after the US retail sales data released. The Dollar Index has reached a fresh high of 92.90, reaches a resistance. However, DXY’s bullishness forced Greenback to appreciate versus all its rivals.

-Are you looking for automated trading? Check our detailed guide-

Fundamentally, the Retail Sales indicator rose by 0.7% in August versus a 0.7% expected to drop after the 1.8% decline registered in July. Moreover, the Core Retail Sales registered a 1.8% growth last month, even though the analysts expected to see a 0.1% decline. On the other hand, the indicator dropped in July by 1.0%. Finally, the US dollar is bullish even if the US Unemployment Claims reported worse than expected data. It was reported at 332K in the previous week above the 325K expected compared to 312K in the previous reporting period.

Later, the US will publish the Business Inventories, which is expected to register a 0.5% growth. Therefore, the USD/CHF pair could approach and reach a fresh new high as long as the Dollar Index climbs higher.

USD/CHF price technical analysis:

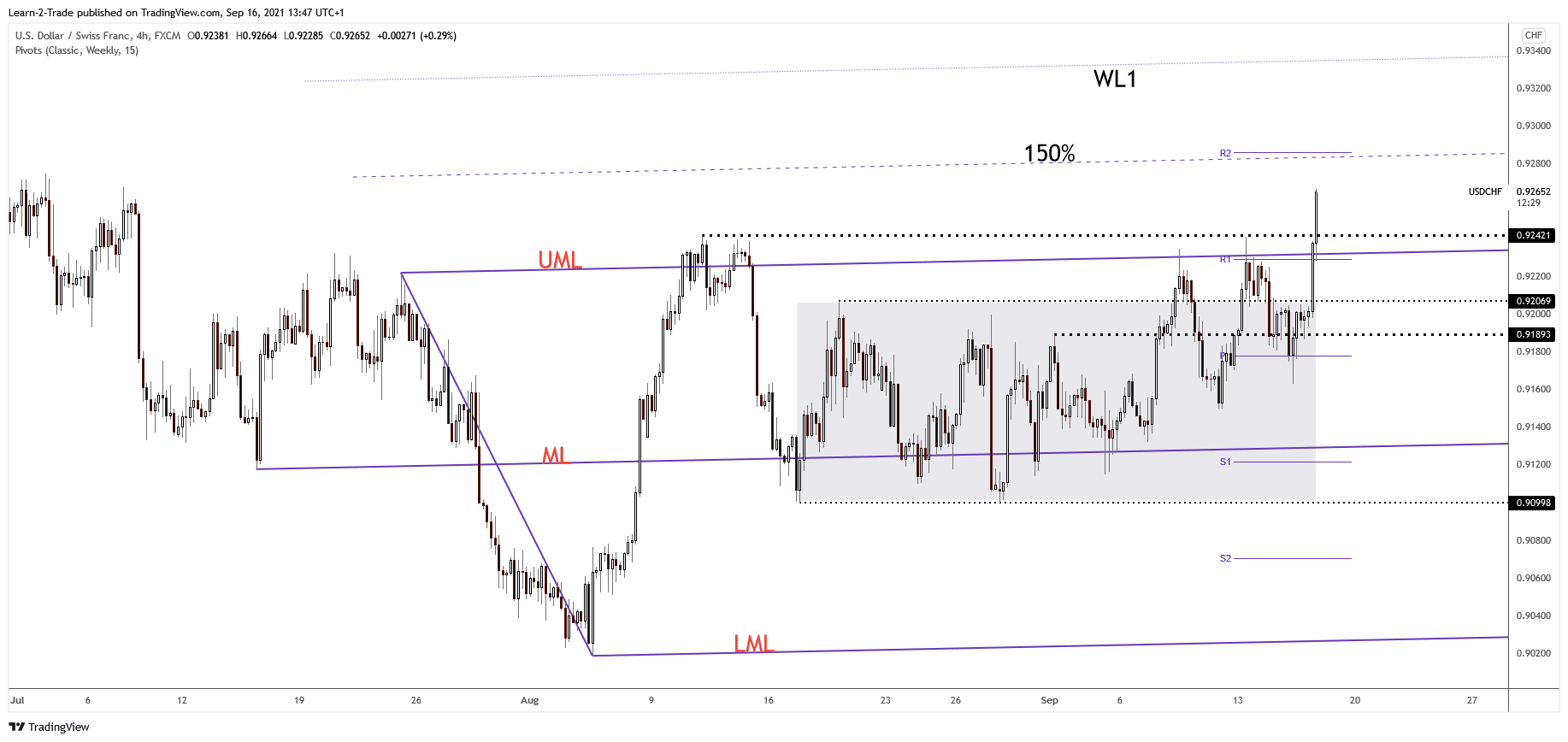

The USD/CHF price has finally jumped above the 0.9242 static resistance, and now it may approach the 150% Fibonacci line and the weekly R2 (0.9286). As you can see, the pair has slipped lower in the short term to retest the 0.9178 weekly pivot point.

From the technical point of view, the USD/CHF pair is strongly bullish after escaping from the ascending pitchfork’s body. Its failure to reach the median line (ML) signaled an imminent upside breakout and continuation.

-If you are interested in forex day trading then have a read of our guide to getting started-

In the short term, we cannot exclude a temporary decline. The price could slip lower after this amazing rally to test the broken levels.

However, resistance has turned into support, so the pair could return to test and retest these levels before jumping towards fresh new highs.

Registering a valid breakout through the 150% Fibonacci line and above the R2 (0.9286) may signal further growth towards the first warning line (WL1).

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.