“¢ Surging US bond yields helps ease the prevalent USD bearish pressure.

“¢ Risk-on mood weighs on CHF’s safe-haven appeal and provides an additional boost.

The USD/CHF pair built on its steady climb from the Asian session low and is currently placed at session tops, around the 0.9925-30 region.

For the second straight session, the pair managed to attract decent buying interest near the 0.9900 handle and was now supported by a modest US Dollar rebound. A fresh wave of an upsurge in the US Treasury bond yields helped ease the USD bearish pressure on Thursday and was seen as one of the key factors behind the pair’s goodish intraday rebound.

Adding to this, a positive outcome from the keenly watched trade-related meeting between the US President Donald Trump and European Commission President Jean-Claude Juncker triggered a global wave of risk-on trade. The same was evident from strong gains across European equity markets, which further weighed on the Swiss Franc’s safe-haven appeal and provided an additional boost.

Technical Analysis

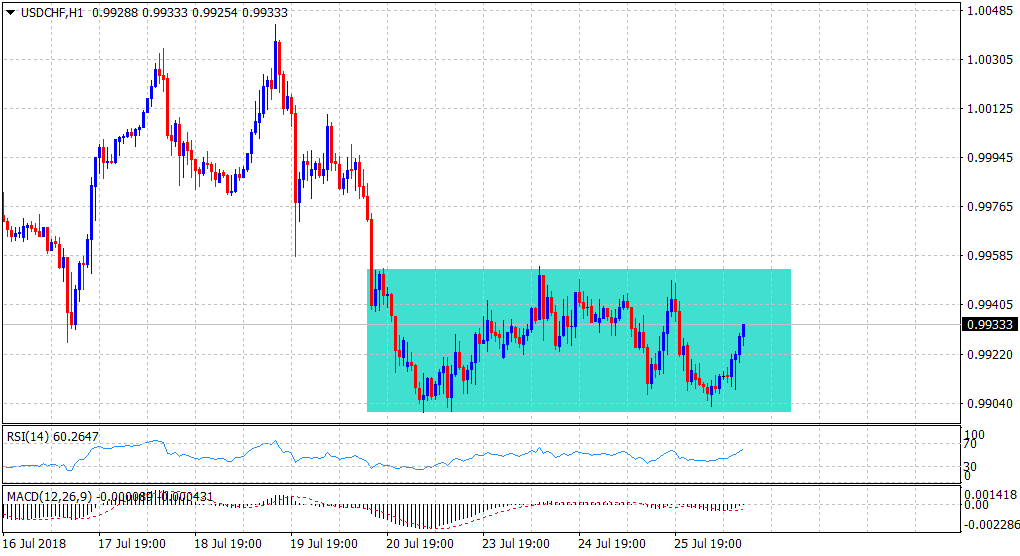

The pair has been oscillating within a narrow trading band since the beginning of this week, forming a rectangular chart pattern on the 1-hourly chart.

Meanwhile, technical indicators on the said chart were seen picking up positive momentum and hence, a retest of the weekly trading range resistance now looks a distinct possibility.

However, it would be prudent to wait for a decisive break-through the mentioned range before positioning for the pair’s next leg of directional move.

Spot rate: 0.9933

Daily Low: 0.9903

Trend: Sideways

Resistance

R1: 0.9954 (weekly tops set on Tuesday)

R2: 0.9987 (R3 daily pivot-point)

R3: 1.0000 (psychological mark)

Support

S1: 0.9901 (lower end of the weekly trading range)

S2: 0.9883 (S2 daily pivot-point)

S3: 0.9858 (monthly low set on July 9)