- USD/CHF nears multiple key upside barriers while trading close to August month high.

- A pullback towards 38.2% Fibonacci retracement can’t be denied but recovery seems to be less diluted unless breaking 0.9780.

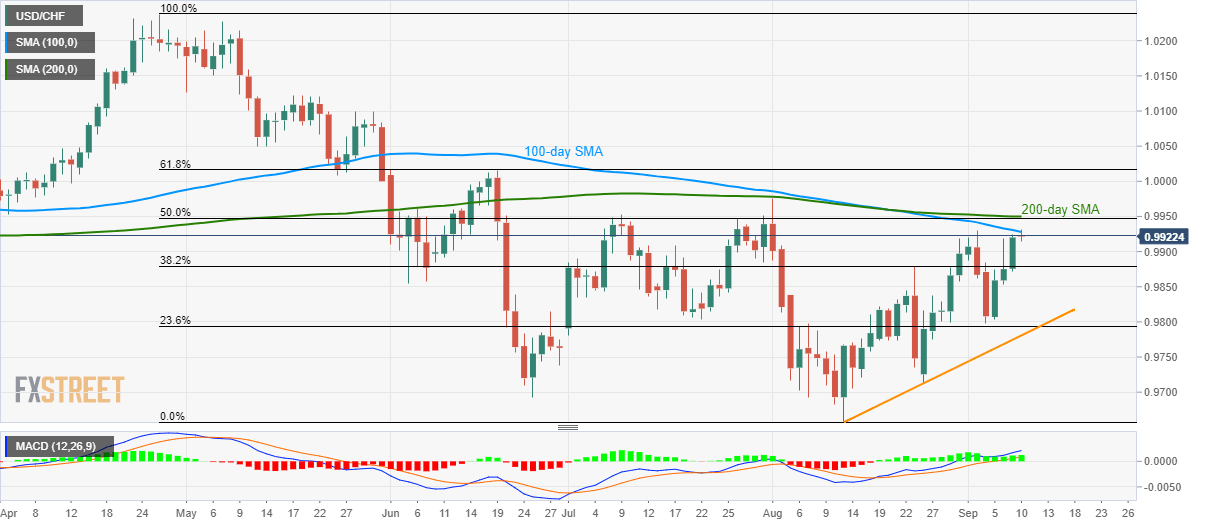

Not one but two key resistances restrict the USD/CHF pair’s recovery as it trades near 0.9920 while heading into Tuesday’s European open.

The 100-day simple moving average (SMA) at 0.9930 acts as immediate resistance whereas the 0.9948/50 confluence, including 200-day SMA and 50% Fibonacci retracement of April-August downpour, raise bars for further upside.

In a case where prices manage to conquer 0.9950 on a daily closing basis, August 01 top surrounding 0.9975 and 1.0000 psychological magnet could become buyers’ favorites ahead of 61.8% Fibonacci retracement of 1.0016.

On the flip side, 38.2% Fibonacci retracement level of 0.9880 can lure sellers ahead of challenging them with 0.9840 and 0.9795 mark including 23.6% Fibonacci retracement.

It should, however, be noted that odds of pair’s upside can’t be denied unless it drops below four-week-old rising trend-line, at 0.9780.

USD/CHF daily chart

Trend: pullback expected