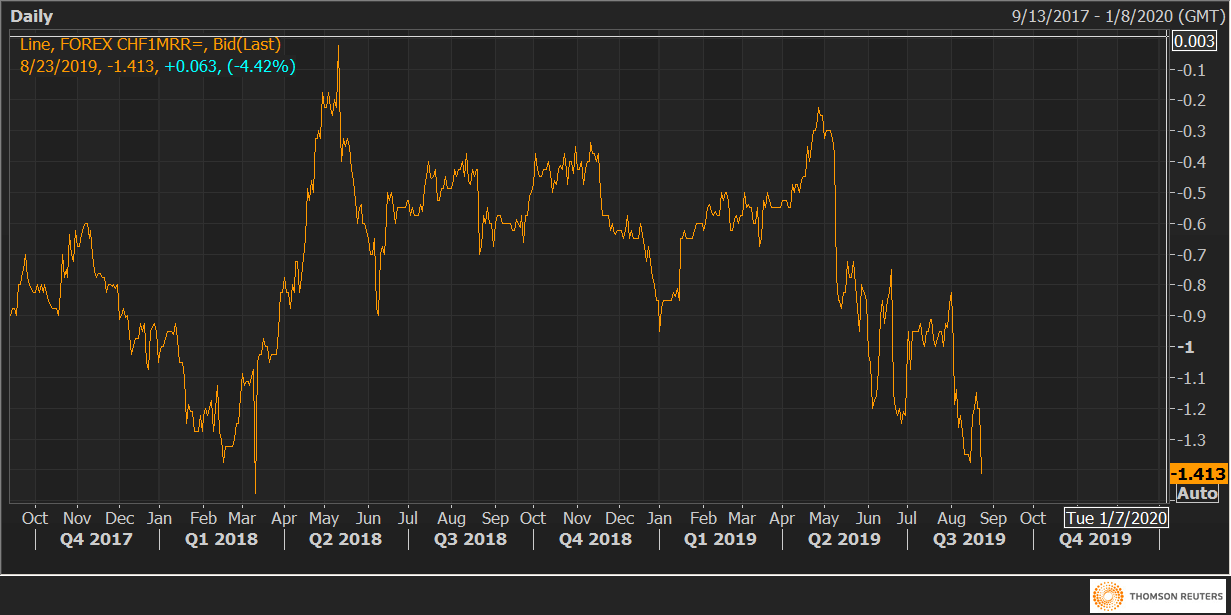

Risk reversals on Swiss Franc (CHF1MRR), a gauge of calls to puts, dropped to the lowest level in 17-months, indicating the investors are adding bets to position for a rise in the Swiss currency.

The USD/CHF one-month 25 delta risk reversals fell to -1.41 – a level last seen in March 2018.

The negative number indicates the implied volatility premium or demand for CHF calls (bullish bets) is higher than that for CHF puts (bearish bets).

Notably, the gauge stood at -0.825 on Aug. 1, meaning the demand for CHF bullish bets has increased sharply this month. After all, re-escalation of the US-China trade tensions have triggered a flight to safety and the Swiss Franc is one of the classic haven currencies.

CHF1MRR