- USD/CNH drops for the third day in a row, battles weekly bottom.

- China’s June month Caixin Manufacturing PMI grew past-50.5 forecast and 50.7 prior to 51.2.

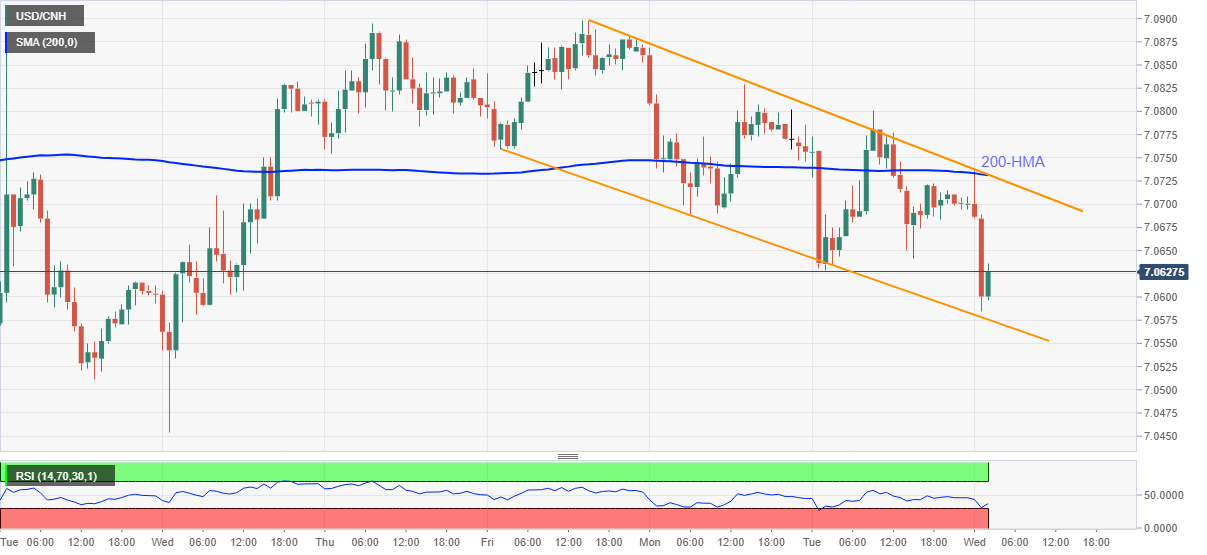

- A support line of the immediate falling channel can challenge further weakness amid oversold RSI.

- 200-HMA, the channel’s upper line will restrict recovery moves.

USD/CNH pares post-China data losses while taking rounds to 1.0625 during the early Wednesday. The pair initially dropped to a one-week low of 7.0585 after China’s Caixin Manufacturing PMI flashed upbeat figures. However, the traders failed to defy a three-day-old falling trend channel during the declines and seem to step back from further selling off-late.

Read: Markit/Caixin manufacturing PMI, June, rises to 51.2, highest since Dec 2019

Other than the channel formation, oversold RSI conditions also suggest further pullback of the USD/CNH prices. In doing so, 7.0700 will become an immediate target for buyers ahead of confronting 200-HMA and the channel’s resistance around 7.0730/35.

Should there be a clear upside past-7.0735, the bulls will aim for late-June top surrounding 7.0900 before attacking 7.1000 threshold.

Alternatively, the pair’s further weakness below the said channel’s support, at 7.0575 now, could aim for 7.0500 as an immediate rest. Though, June month’s low near 7.0400 will become the key support afterward.

USD/CNH hourly chart

Trend: Pullback expected