- CNY sell-off continues on hawkish Fed and trade concerns.

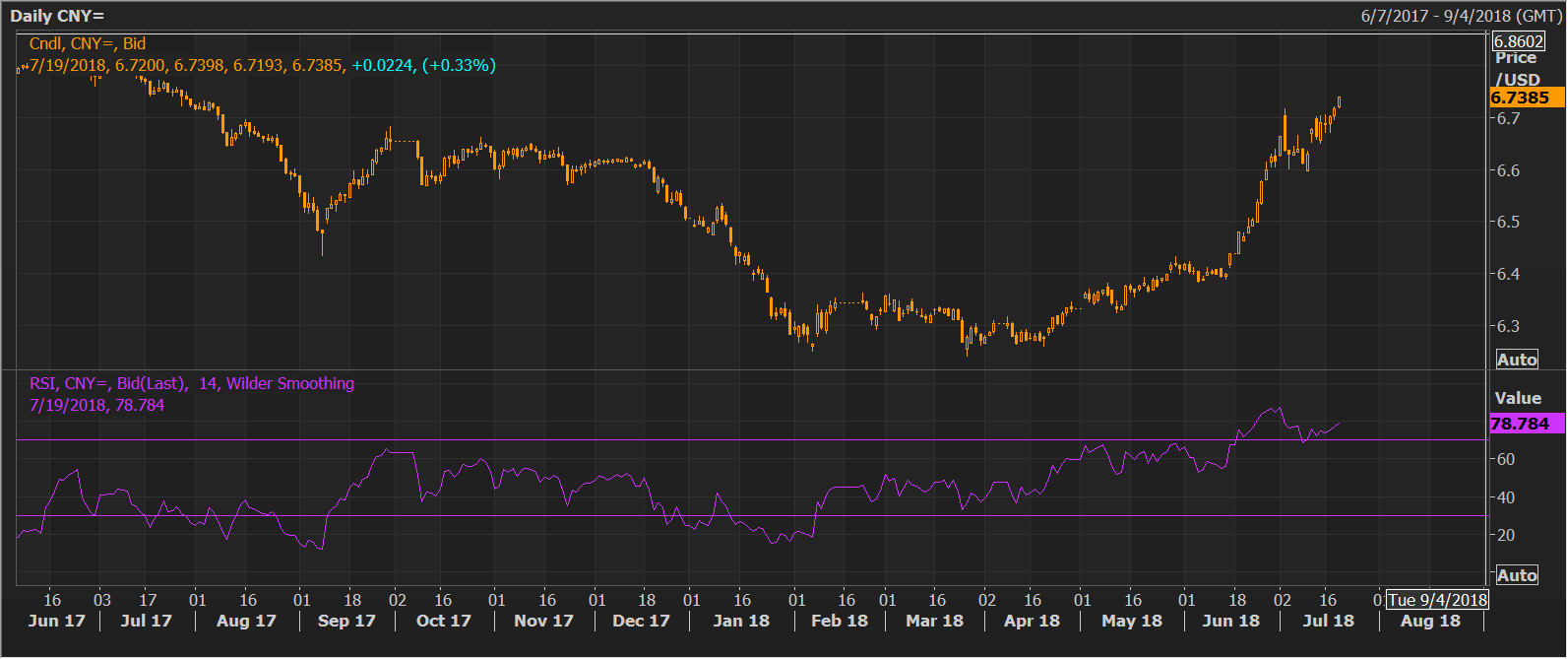

- The USD/CNY RSI continues to report overbought conditions.

The USD/CNY pair rose to 6.7398 today – the highest level since July 28, 2017.

The Chinese currency continues to take a beating on trade tensions. President Donald Trump’s top economic advisor Larry Kudlow said Con Wednesday that China trade talks have stalled, triggering fears of a further escalation of a trade war between the top two economies of the world.

Further, the US dollar is solid bid as the Federal Reserve Chairman Jerome Powell gave an upbeat outlook for the US economy during this testimony to Congress, reinforcing views that the Central bank is on track to steadily hike interest rates.

Clearly, the rate differential is set to widen further in the CNY-negative manner (USD/CNY-positive manner).

That said, a quick pullback could still happen as the 14-day relative strength index (RSI) is holding well above 70.00, signaling overbought conditions.

USD/CNY Technical Levels

Resistance: 6.7598 (June 30, 2017 low), 638071 (July 11, 2017 high).

Support: 6.7168 (July 3 high), 6.5980 (July 10 low).