The Federal Reserve raised rates and the skies didn’t fall. In the following week, we do see some weakening of the dollar.

What’s next? Here are some thoughts from the team at Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

Some global investors expect the US dollar will strengthen enough in 2016 to materially slow down the Fed’s hiking cycle.

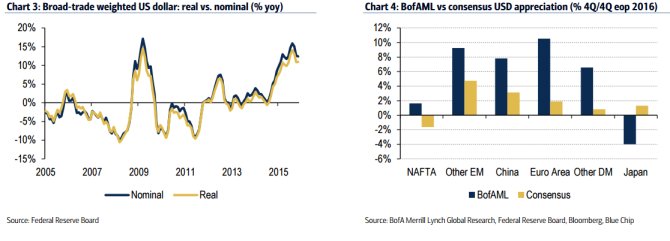

While the US dollar may move sharply against some currencies next year, we estimate a real trade-weighted USD index will rise only modestly by end-2016.

Don’t fear the Fed:

What does this all mean for the Fed? In our view, the Fed is likely to tolerate a modest rise in the real trade-weighted US dollar, which is how the Fed assesses the strength of the US dollar.Fed models suggest that a 10% appreciation of this measure, over a year, starts to have measurable impacts upon growth and inflation, and the effects can last for a few years.

The March FOMC meeting may give some additional clues: the broad trade-weighted dollar index had risen over 10% yoy in real terms as of that point, while the major currency index had risen nearly 20%. Those are likely upper bounds on how much of a rise the Fed may tolerate this time around, in part because the full impact of the earlier appreciations are still working through the economy, and in part because growth is expected to be closer to potential and inflation has remained well below target.

Given the size of the forecasted move in the real trade-weighted USD is not all that large by end-2015, we suspect the Fed will be able to look through the increase “” in contrast to the not uncommon view that the Fed may have to delay its hiking cycle next year as the dollar rises.

Stepping back, a very gradual Fed hiking cycle is unlikely to be nearly as disruptive to the global economy as some of the more bearish views suggest. Recall the Fed is not trying to slow down US growth or fight high inflation; the Fed will only continue to normalize policy if the US economy can handle it. And as we noted two weeks ago, there is still plenty of central bank liquidity to go around; its pace of expansion isn’t likely to see any interruption over the next few years. A rising tide of global liquidity lifts all economies. This is why, for example, the US equity market rallies on dovish ECB news. Thus the overall stance of global monetary policy remains supportive even after Fed liftoff “” and despite the onset of the “policy divergence era.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.