The US dollar has bounced back on “risk off” with the chances of Brexit rising. What’s next for the USD? The team at Credit Agricole analyzes.

Here is their view, courtesy of eFXnews:

The USD sold off across the board after much weaker May NFP than expected. The market reaction suggests that investors do not necessarily believe that the poor data print signals an immediate threat to the US recovery. At the same time, they do expect the uneven US recovery to stay the Fed’s hand for now.

The near-term path of the USD will depend on the timing of the next Fed rate hike. Ahead of the June FOMC meeting, investors will look for more clarity on the Fed outlook in coming months. A repeat of Ms Yellen’s recent vagueness could mean that the USD may struggle to perform.

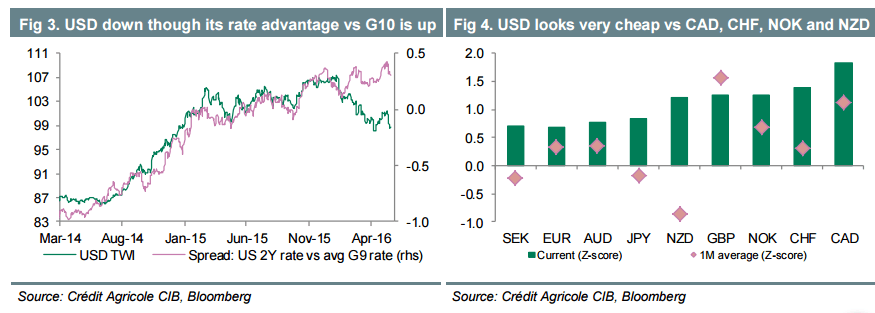

That said, some negatives are clearly in the price, as suggested by the dovish price action in the US rates markets. In addition, even as the USD has sold off, its rate advantage vs G10 seems to have grown of late.

According to that measure, the USD looks cheap against CAD, CHF, NOK and NZD. We expect limited USD downside from here and maintain our longer-term constructive outlook, especially against G10 commodity currencies such as CAD and AUD.

The view is further corroborated by the deteriorating outlook for the global economy and the uneven recovery in the US. We expect that the growing threat of protectionism ahead of the US presidential elections to add further to global trade and growth headwinds. While these developments may limit the Fed’s ability to hike from here, they should fuel more market uncertainty and boost the USD performance against commodity and risk-correlated currencies.

Our FX forecasts already reflect some of these fears. In particular, we see less pronounced USD outperformance against safe-haven currencies such as EUR and JPY. Contingent on our Fed view, which still foresees two rate hikes in 2016, we remain ready to downgrade the USD forecasts further.

At the same time, we stuck with our less constructive view on commodity currencies, and continue to expect CAD, AUD, NOK and, to a degree, NZD to underperform USD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.