The US dollar has been on a roll and the euro retreated on Draghi. However, the team at NAB sees limited gains moving forward:

Here is their view, courtesy of eFXnews:

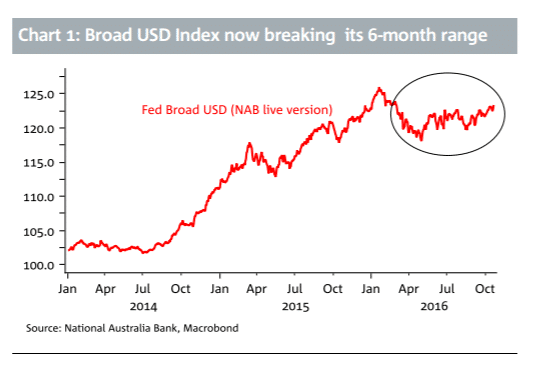

Slowly but surely the USD is flexing its muscles once again. The greenback’s 25% rally from July 2014 to January this year was of course halted by an increasingly vocal Fed that during the first few months of this year became more aware and seemingly concerned about the consequent tightening of financial conditions from the currency’s gains.

The USD looks to be breaking higher again, last week popping above its multimonth range highs to sit around 2.5% below the January multi-year peak. The gains are broad-based as depicted by our USD/Major and USD/EM trade-weighted indices (see p.1, while the popular but EUR heavy DXY Index – which notched up two 12-year peaks just above the 100 level in 2015 (March and December) is also just 2% below said peaks.

We can cite the falling GBP, a slide in the EUR as well as a list of idiosyncratic weaknesses across EM like TRY, ZAR and THB as factors aiding the USD. The CNY, which has a dominant 21% weighting in US trade weighted indices has lost some 5% since April, when the broad USD halted its pullback. In addition a December Fed hike is pretty consistently priced around 75%, with the current data flow supportive of a move then.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

With all this going on it’s difficult to argue against more of the same (USD strength) aided by rising confidence in a Clinton victory and associated asset market relief that bolsters not just confidence in a 2016 Fed hike but a Fed potentially operating against a backdrop of increased fiscal spending that supports growth. Before getting carried away, we are reminded of Fed’s estimates that a 10% rise in the USD subtracts around 1.5% from GDP, albeit with a lag and 0.5% or so off of core inflation. With the Fed about to go into pre-FOMC lockdown, we won’t be hearing anything from Fed officials on this subject in the next 10 days or so.

The ECB meanwhile has muddied the waters by setting up 8 December for when it will reveal plans for the fate of QE in 2017. EUR/USD has come lower on this (though the USD in general has firmed) with markets as yet unconvinced tapering will come as soon as April. Since we regard it as more likely than not, an announcement of such would likely provide support for EUR/USD amidst a stronger USD backdrop. Enough, we’d gauge, to limit EUR/USD downside to ~1.08 and even allow for a year-end rally.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.