The Fed convenes after raising rates last time and as Trump makes his dent in the Oval Office. What can we expect?

Here is their view, courtesy of eFXnews:

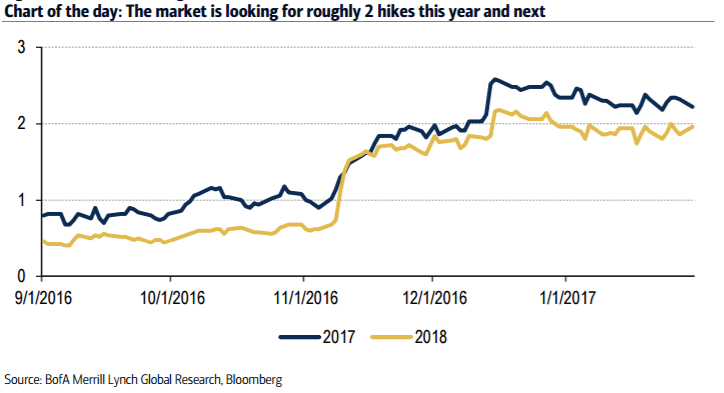

We do not expect fireworks from the upcoming FOMC meeting. The Federal Reserve will be releasing its statement without a press conference or Summary of Economic Projections (SEP), which offers market participants less information to digest. We do not expect policy changes, with the FOMC holding rates at the 50-75bp range and maintaining the reinvestment policy. However, we do expect changes to the language. In particular, we think the Fed will highlight the reduction in labor market slack and perhaps note that confidence measures have improved. In our view, these changes would be perceived as a bit more hawkish. The market is pricing in just over two hikes this year and another two in 2018 (Chart of the day).

We similarly look for four hikes over this year and next, but believe the risk is for a faster cycle to start next year. If the communication sounds modestly more hawkish, we expect it to result in a further steepening of the near-term path of monetary policy and believe it could increase market-implied probabilities for a March hike.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

FX: refocus on Fed could provide a reprieve for USD even with little expected.

The minor tweaks to language, as described above, could lend a slightly more optimistic tone, potentially suggesting some upside risks to FOMC pricing. While FX moves are likely to be limited, a more confident tone could provide some reprieve to the USD as the market refocuses attention on the balance of risks around Fed policy, which we continue see as skewed toward faster hikes on growth-positive fiscal stimulus.

With Inauguration Day out of the way, we continue to expect President Trump’s fiscal and tax plans to support the USD, albeit in a choppier manner given the administration’s greater penchant to talk it down.

Additionally, the decline in real rates that has taken the dollar with it recently, should be short-lived (Liquid Insight: The Trump trade divergence), particularly if the Fed turns increasingly hawkish amid rising inflation and further declines in the unemployment rate.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.