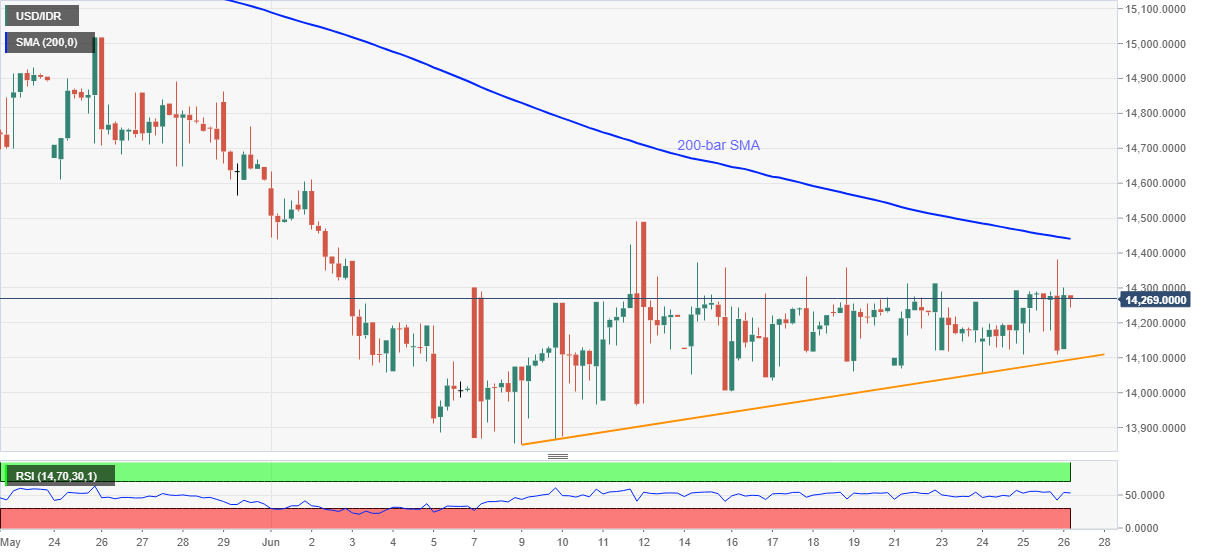

- USD/IDR keeps recovery moves from June 09, surged to two-week high the previous day.

- 13-day-old rising trend line normal RSI conditions favor the pair’s further advances.

- June 11 top offers validation to the rise beyond 200-bar SMA.

- Monthly low can lure the bears beneath the short-term support line.

USD/IDR consolidates the previous day’s upside momentum while taking rounds to 14,273 during the pre-European session on Friday. The pair prints a gradual pullback since June 09, as portrayed by short-term trend line support. However, 200-bar SMA stands tall to question the bulls.

Other than the 200-bar SMA level of 14,440, Thursday’s high of 14,380 and June 11 top surrounding 14,490 are some immediate additional resistances to watch during the further recovery.

Given the buyers’ ability to conquer 14,490, the monthly top around 14,610 might offer an intermediate halt ahead of propelling the quote towards 15,000 threshold.

On the downside, a clear break below the said support line, at 14,095 now, may take a rest near 14,000 round-figure before challenging the monthly bottom close to 13,850. If at all the bears remain dominant past-13,850, February month’s low near 13,600 will be on their radars.

USD/IDR four-hour chart

Trend: Further recovery expected