- Oversold RSI and expectations of the BI rate cut pulled the USD/IDR pair up.

- 14,075/80, the eight-week-old descending trend-line and 100-day EMA also stand tall to question bulls.

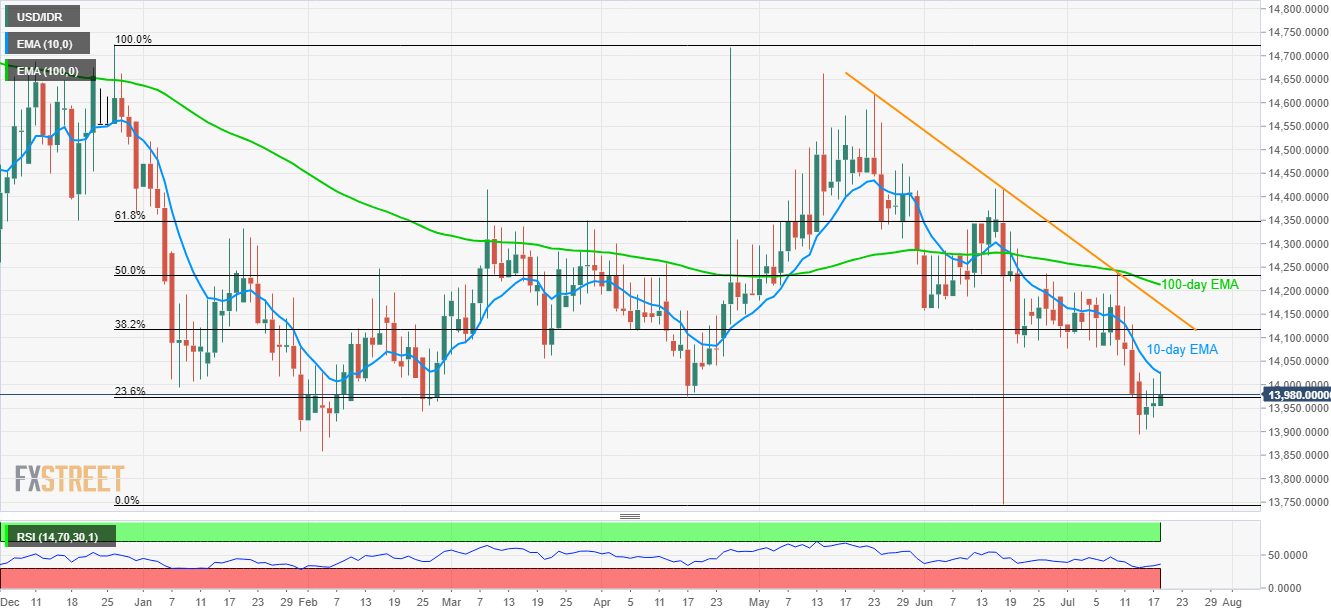

Although growing market expectations that the Bank Indonesia (BI) will announce a cut to its headline BI rate in today’s monetary policy meeting recently triggered the USD/IDR pair’s pullback amid oversold RSI, the quote is yet to clear 10-day EMA while making the rounds to 13,980 during early Thursday.

Not only 10-day exponential moving average (EMA) surrounding 14,023/25, but multiple lows between late-June and July 09 surrounding 14,075/80 can also limit the pair’s immediate upside.

In a case prices rally past-14,080, a downward sloping trend-line since late-May, at 14,172, followed by 100-day EMA level of 14,213, may gain bulls’ attention.

Should sellers refrain from respecting oversold levels of 14-day relative strength index (RSI), multiple supports close to 13,950/40 and recent bottom around 13,890 can entertain them ahead of pushing towards February month low of 13,858.

USD/IDR technical analysis

Trend: Pullback expected