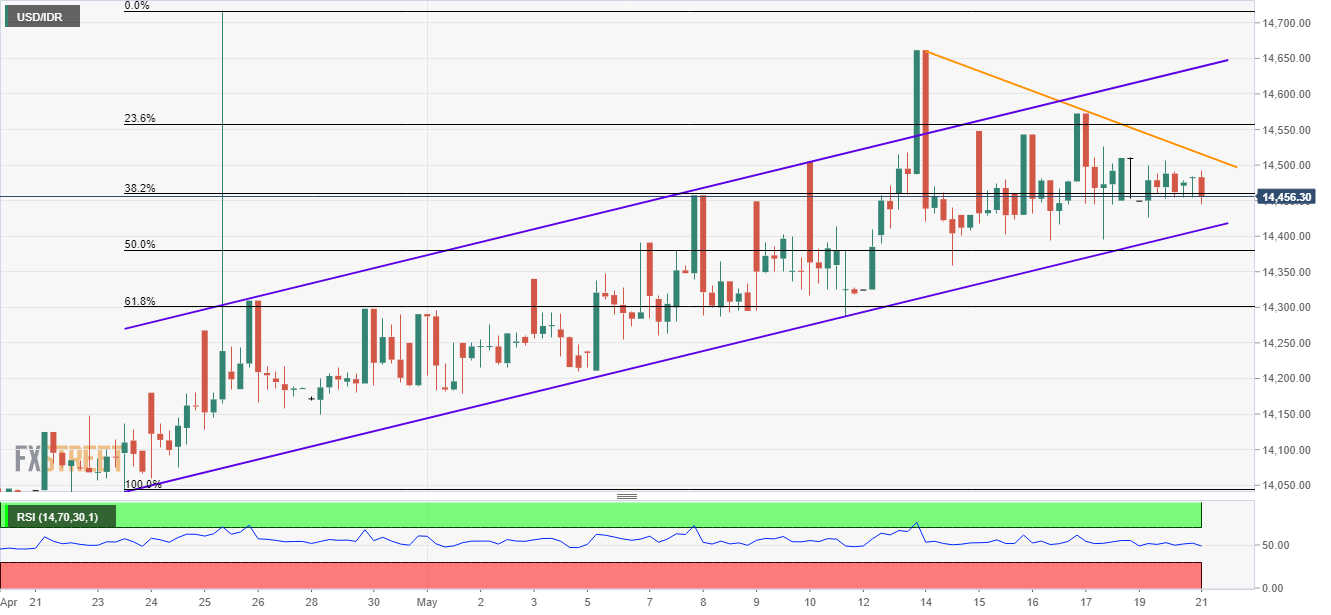

- A month-old ascending channel portrays the pair’s strength.

- Immediate downward sloping trend-line questions the upside momentum.

With a week-long descending trend-line challenging its near-term upside bias, the USD/IDR pair trades near 14,460 during early Tuesday.

The pair has been following an upward sloping trend-channel formation since late-April but its latest trading pattern gives rise to an immediate resistance-line on H4.

As a result, 14,520 can act as immediate resistance for the pair ahead of 14,580 and the channel’s upper-line of 14,640.

Should there be increased upside past-14,640, the quote can extend its north-run towards 14,665 and 14,720.

Meanwhile, a downside break of channel-support, at 14,410 now, can trigger fresh declines in the direction to 61.8% Fibonacci retracement of late-April upside, at 14,300.

Given the bears’ refrain from respecting 14,300 rest-point, 14,180 and 14,100 can offer intermediate stops to the downturn targeting 14,000 mark.

USD/IDR 4-Hour chart

Trend: Pullback expected