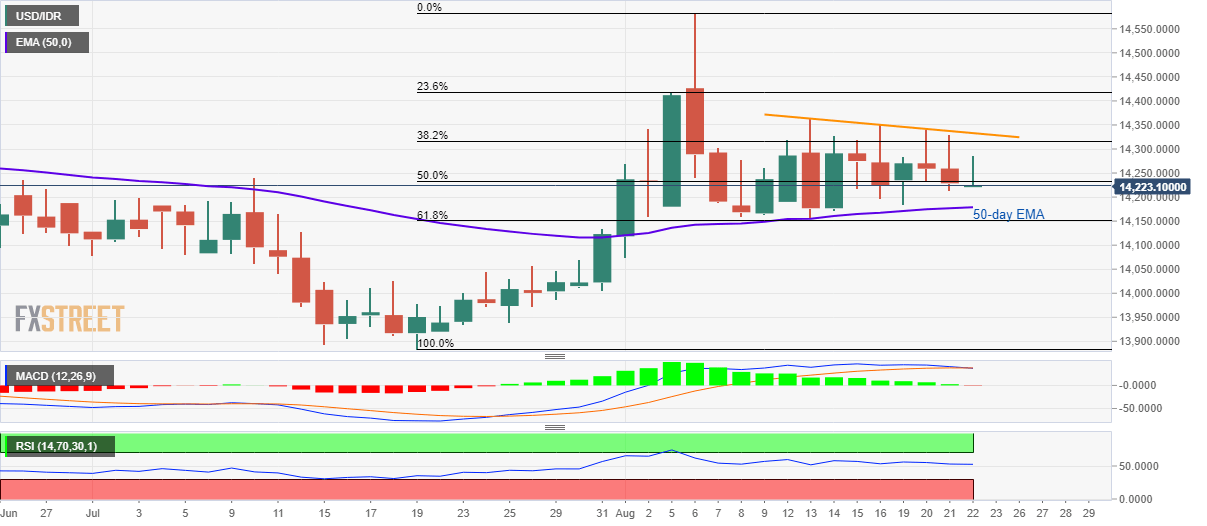

- USD/IDR remains on a back foot lobe seven-day old falling trend-line.

- 50-day EMA, 61.8% Fibonacci retracement gain sellers’ attention.

- MACD, RSI signal further weakness.

With the key technical indicators limiting the USD/IDR pair’s moves, the quote seesaws near 14,230 during early Thursday.

In addition to the downward sloping trend-line since August 13 limiting the pair’s immediate upside, at 14,333, gradually declining 14-bar relative strength index (RSI) and 12-bar moving average convergence and divergence (MACD) also portrays the pair’s weakness.

As a result, chances of its declines to 50-day exponential moving average (EMA) level around 14,180 and then a following drop to 61.8% Fibonacci retracement of July-August upside, at 14,150, can well be anticipated.

During the pair’s south-run past-14,150, 14,000 and July 19 low near 13,880 gains sellers’ attention.

Alternatively, an upside break of 14,333 resistance-line can trigger fresh increase towards 23.6% Fibonacci retracement level close to 14,420 whereas monthly high near 14,580 will lure bulls then after.

USD/IDR daily chart

Trend: Bearish