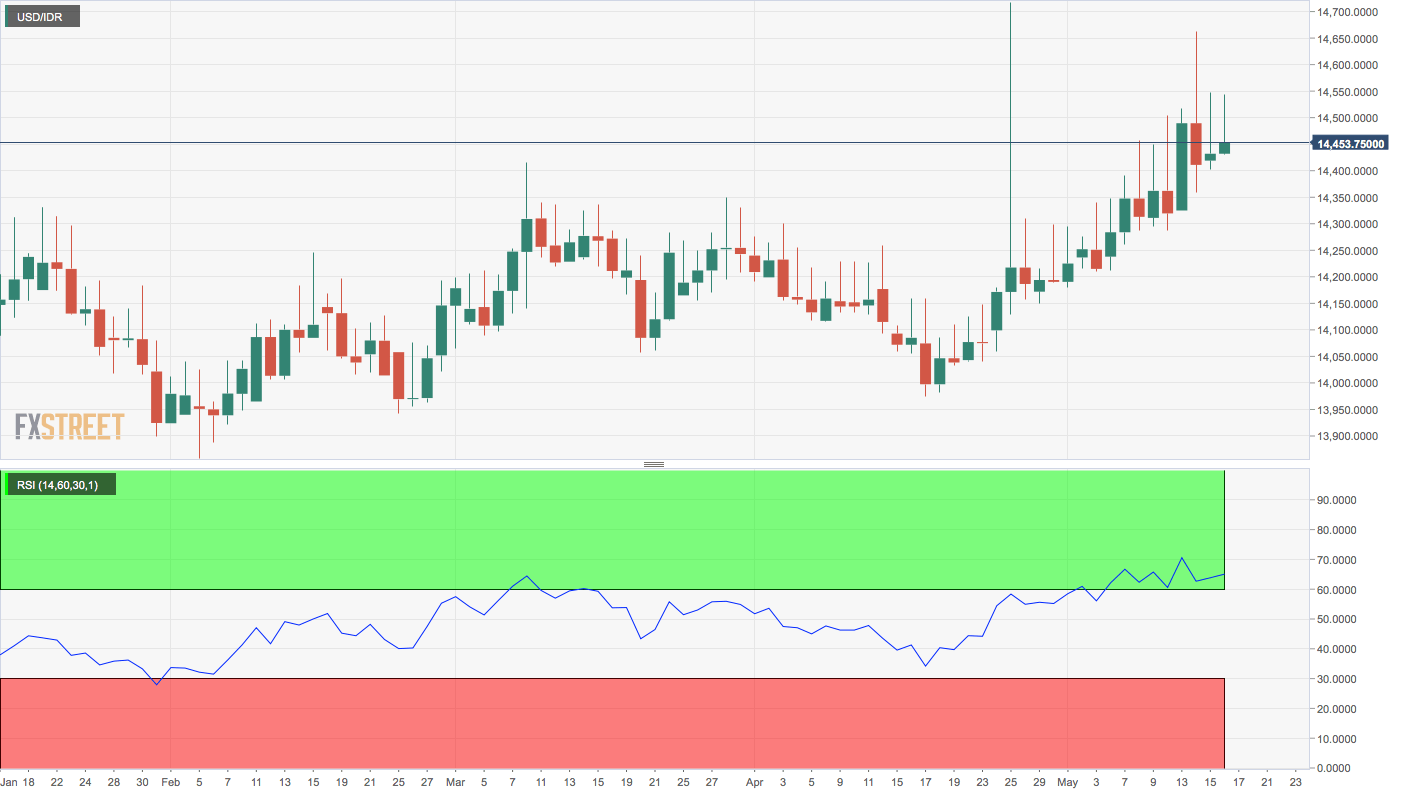

- USD/IDR’s relative strength index is reporting overbought conditions for the first time since October.

- Indonesia’s central bank is expected to keep rates unchanged today.

USD/IDR’s 14-day relative strength index (RSI) is holding above 75 for the first time since October. An above-70 print represents overbought conditions.

The Indonesian Rupiah, therefore, is looking oversold against the US dollar. The currency has dropped by 3.32% over the last three weeks and fell to 14,465 per US dollar earlier today, the lowest level since early January.

The recent sell-off could be associated with expectations that Indonesia’s central bank will soon begin easing cycle and trade tensions.

The central bank, however, is expected to keep rates unchanged later today, but may sound dovish. After all, the economy grew more slowly than expected in the first quarter.

Daily chart

Trend: Overbought

Pivot points