The US dollar had a mostly positive week last week, but against some currencies, it is still struggling. What about the technicals on the US dollar index?

Here is their view, courtesy of eFXnews:

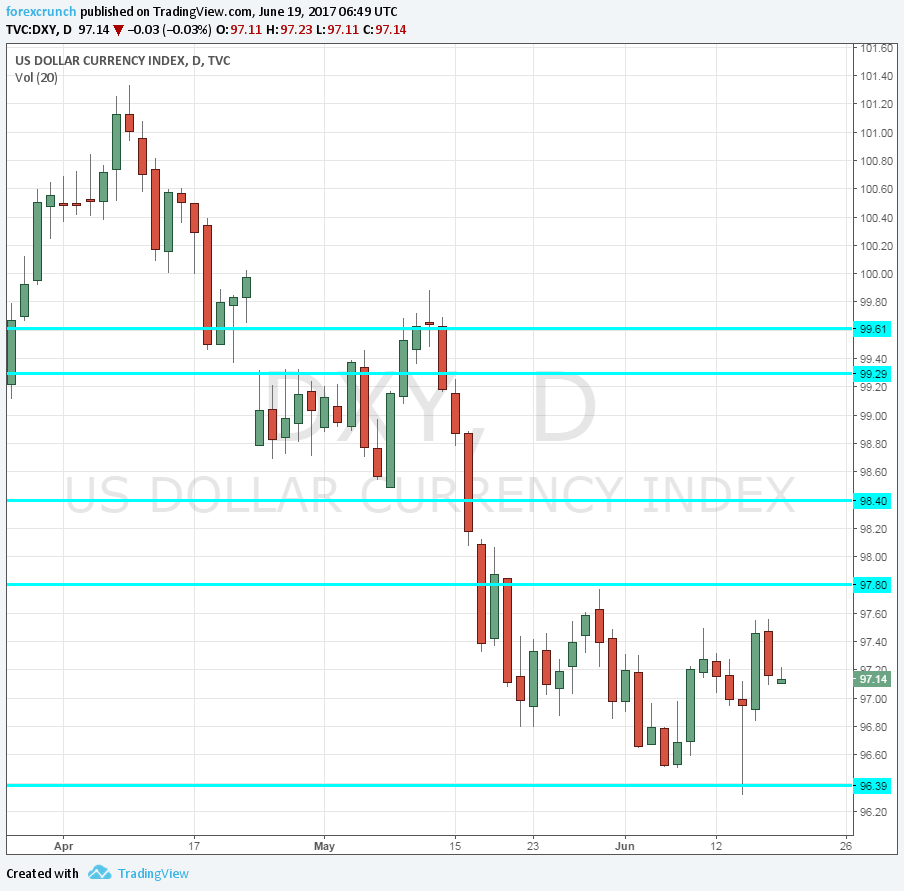

Bank of America Merrill Lynch FX Technical Strategy Research notes that the weekly chart of the DXY is most oversold according to RSI, while the BBDXY charts show a daily TD Sequential buy signal at weekly trend line support and this supports a bounce.

“The DXY declined below 97.50, which we said was a risk, exceeds the minimum requirement for a corrective wave c to end.

However we remain aware a deeper wave c could extend as low as 94.85 while market profile targets 95.50,” BofAML projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.