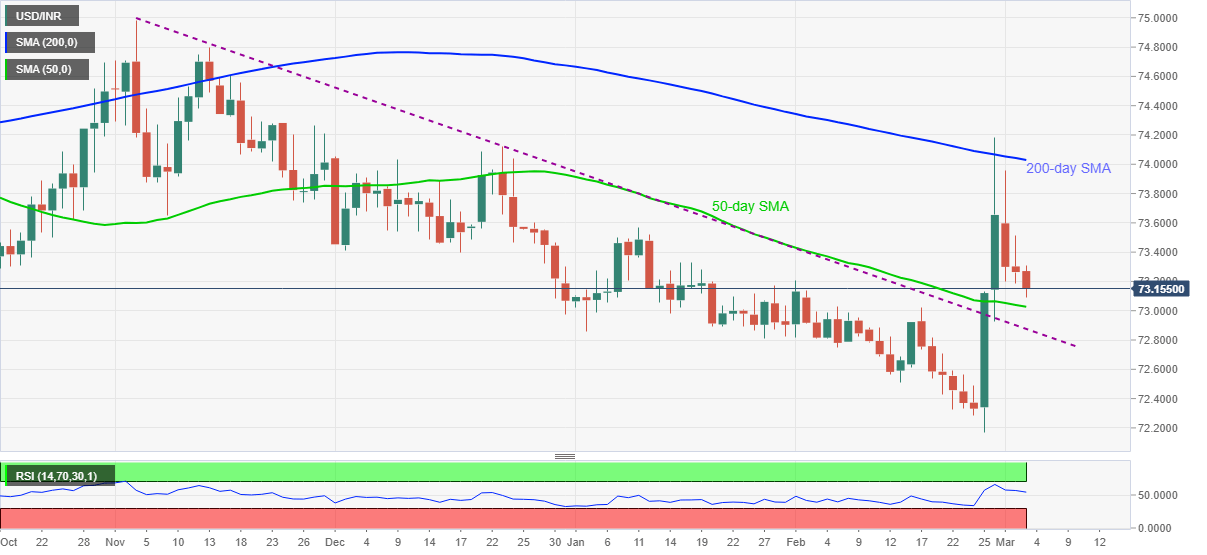

- USD/INR stays offered near weekly bottom, prints three-day losing streak.

- 50-day SMA, four-month-old falling trend line offer immediate support.

- Bulls can look for a daily close beyond 200-day SMA for trend reversal.

USD/INR holds lower ground near 73.12, down 0.20% intraday, amid the initial Indian session on Wednesday. In doing so, the quote drops for the third consecutive day after stepping back from 200-day SMA on Friday.

Not only another U-turn from 200-day SMA but downward sloping RSI also directs USD/INR sellers towards re-testing the 50-day SMA level of 73.02.

However, the pair’s weakness past-73.02 will be challenged by the 73.00 threshold and the prior resistance line from November, currently around 72.85.

Meanwhile, fresh upside momentum can aim for 73.50 and the 74.00 round-figure before trying to conquer the tough nut to the north, namely the 200-day SMA level of 74.02.

Although USD/INR bulls are likely not to cross the 74.02 hurdle, a daily closing beyond the same will not hesitate to poke the late 2020 top close to the 75.00 level.

USD/INR daily chart

Trend: Further weakness expected