- USD/INR fails to keep bounces off the multi-day-old support line.

- Downbeat MACD signals also direct sellers toward 61.8% of Fibonacci retracement.

- Bulls can look for entries beyond the bi-annual resistance line.

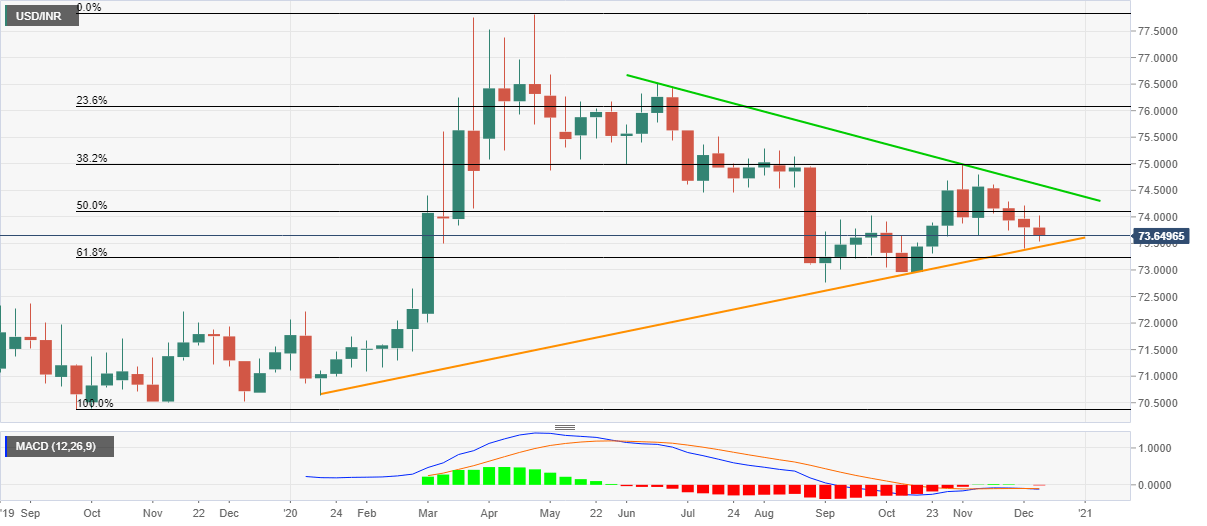

USD/INR stays depressed near the intraday low of 73.64, down 0.15% on a day, amid the initial Indian session on Thursday. In doing so, the quote declines for the fourth consecutive week while also failing to keep the bounce off an ascending trend line from January 17, 2020.

It should also be noted that the MACD signals and a sustained trading below 50% Fibonacci retracement of September 2019 to April 2020 upside also favor USD/INR sellers.

As a result, the bears are targeting to conquer the key support line, at 73.43 now, ahead of eyeing the 61.8% Fibonacci retracement level of 73.23.

If at all the quote refrains from bouncing off 73.23, the 73.00 threshold will become the market favorite.

On the flip side, the 74.00 round-figure precedes the 50% of Fibonacci retracement near 74.10 to challenge short-term USD/INR buyers.

In a case where the upside momentum lasts beyond 74.10, a descending trend line from June 19, 2020, currently around 74.60, becomes the key to watch.

USD/INR weekly chart

Trend: Bearish