- USD/INR bounces off the lowest since March 2020.

- Weekly resistance line, 200-bar SMA guard immediate upside.

- Early 2020 tops challenge further declines ahead of the 72.00 threshold.

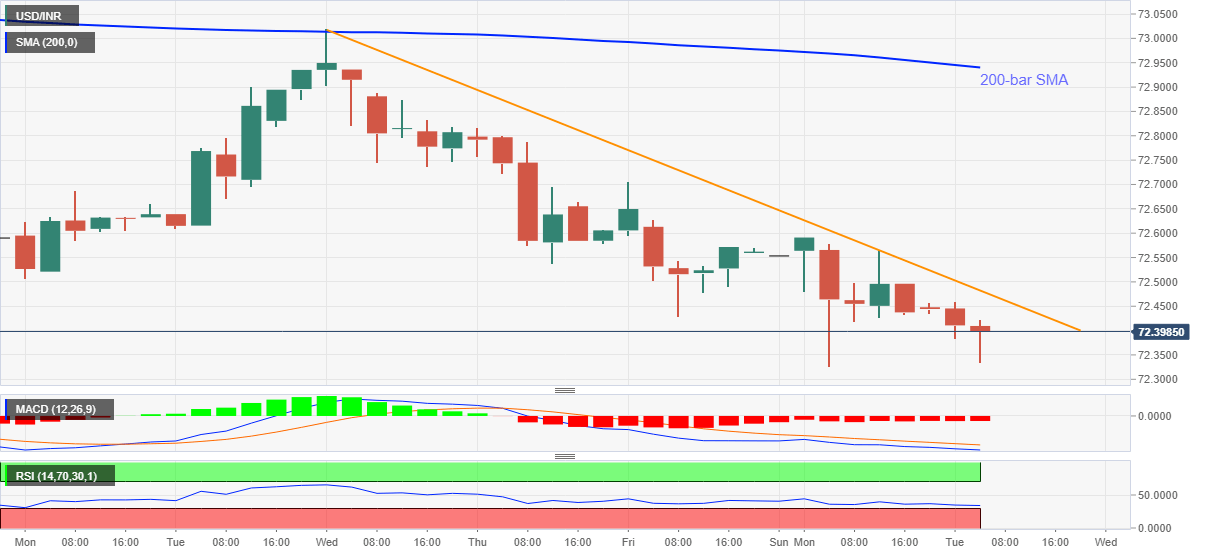

USD/INR marks a corrective pullback to 72.40, despite staying depressed for the fifth consecutive day, during the initial Indian session on Tuesday. The quote refreshed an 11-month low the previous day but failed to slip beneath 72.32.

While nearly oversold RSI conditions suggest a mild pullback in USD/INR prices, a downward sloping trend line from the last Wednesday, around 72.50, could lure the counter-trend traders.

It should, however, be noted that the quote’s run-up from 72.50 will eye reversing the latest south-run while attacking the 200-bar SMA level of 72.94. Also acting as an upside filter is the 73.00 round-figure.

Given the multiple speed-breakers to the north, USD/INR buyers are likely to have a bumpy road.

However, the quote’s further weakness isn’t so smooth as January 2020 tops near 72.20 and the 72.00 can test the USD/INR bears ahead of directing them to the yearly low of 70.51.

USD/INR four-hour chart

Trend: Further recovery expected