- USD/INR stands on slippery ground, eyes the lowest levels since December 02.

- Multiple stops can probe further downside before October lows.

- 100-bar SMA, three-week-old resistance line challenge bulls during the pullback.

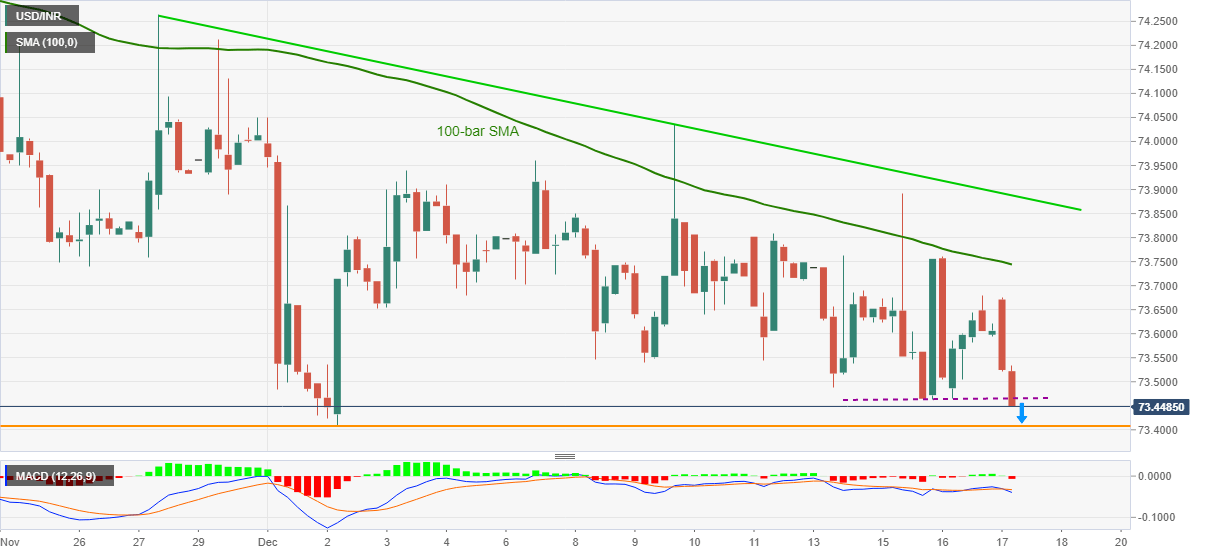

USD/INR drops to 73.45, down 0.21% intraday, amid the initial Indian trading session on Thursday. In doing so, the pair slips below the weekly bottom while eyeing the monthly trough.

Considering the bearish MACD, as well as sustained trading below 100-bar SMA and a falling trend line from November 27, USD/INR is likely to stay south for a bit longer.

However, a clear downside break below the monthly low of 73.41, will find multiple supports around 73.30 and 73.20 before directing sellers toward the October trough near 72.95.

Meanwhile, any pullback will have to cross the 100-bar SMA level of 73.74 to convince USD/INR buyers. Also acting as an upside hurdle is a short-term resistance line, at 73.88 and the 74.00 round-figure.

In a case where the bulls remain dominant past-74.00 round-figure, late-November highs near 74.25/30 will be the key.

USD/INR four-hour chart

Trend: Bearish