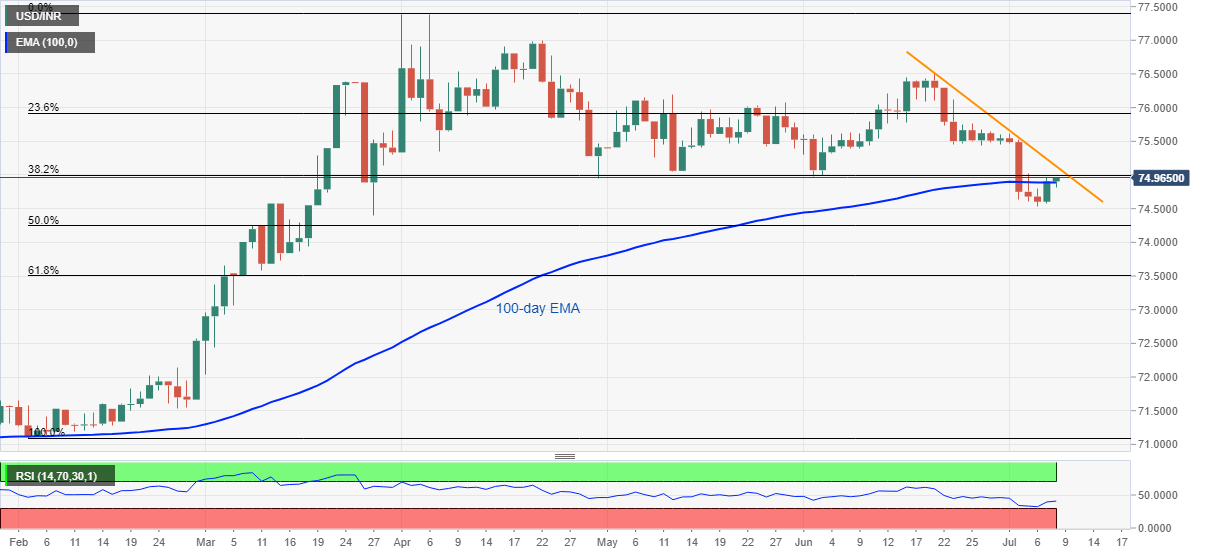

- USD/INR again confronts 38.2% Fibonacci retracement after piercing 100-day EMA.

- The pair’s repeated failures to cross the key Fibonacci retracement level comprising lows marked since April favor the sellers.

- Bulls will look for entry beyond a descending trend line from June 19.

USD/INR takes the bids near 74.96, up 0.08% during the initial hours of Indian session on Wednesday. In doing so, the quote extends Tuesday’s pullback moves while staying below 38.2% Fibonacci retracement of February-April upside. Additionally, the pair’s latest break above 100-day EMA level near 74.90, makes it hopeful to again attack the key resistance.

Should the USD/INR prices offer a daily closing beyond 75.00 mark, comprising 38.2% Fibonacci retracement, it can challenge the falling trend line from June 19, at 75.13 now. Though, the pair’s further upside will be compressed by 75.45 and multiple tops marked during the May month around 76.20.

It should also be noted that the pair’s ability to cross 76.20 on a daily basis will quickly attack June month’s top around 76.50.

On the downside, a daily close below 100-day EMA level of 74.90 may recall the weekly bottom, also the lowest since March 27, nearing 74.50.

Though, the pair’s additional weakness will be questioned by 50% and 61.8% Fibonacci retracement levels of 74.25 and 73.50 respectively.

USD/INR daily chart

Trend: Further recovery expected