- USD/INR reverses the previous week’s gains, refreshes intraday low off-late.

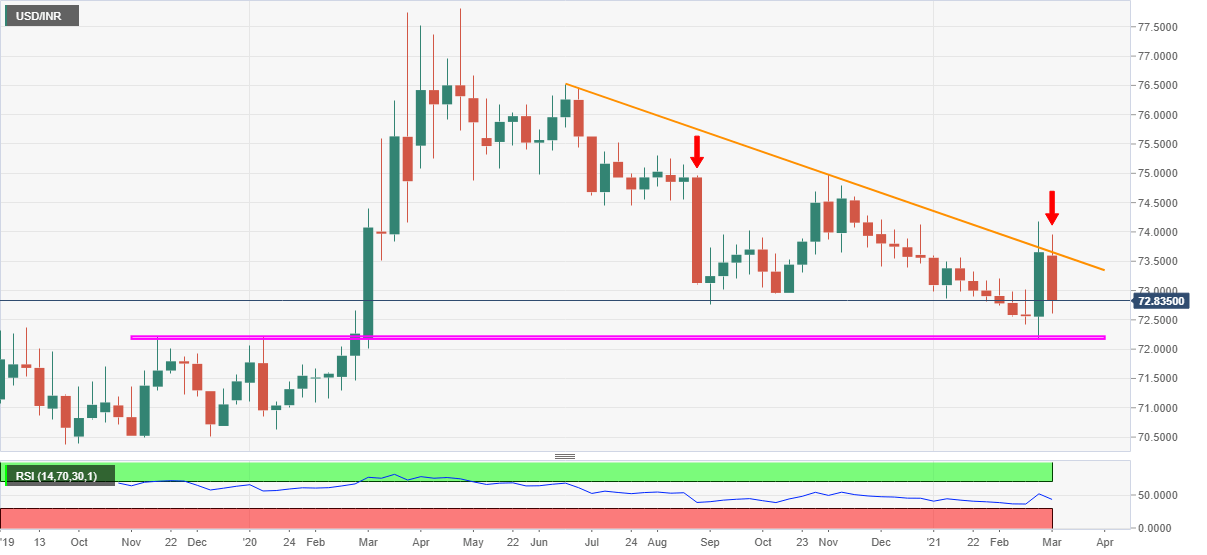

- Nine-month-old resistance line guards upside, bears eye horizontal support since November 2019.

USD/INR remains pressured around 72.84, down 0.44% refreshing intraday low, during the initial Indian session on Friday.

In doing so, the Indian rupee pair reverses the previous week’s heavy gains that refreshed the yearly top, before stepping back from a descending resistance line from June 2020.

Although notable weakness from the key resistance line joins normal RSI to please USD/INR bears, a horizontal area comprising multiple levels since November 2019, around 72.20-15, becomes a tough nut to crack for them.

Meanwhile, an upside clearance of the 73.65 hurdle, including the stated resistance line, needs to cross the previous week’s top near 74.20 to visit November 2020 peak surrounding the 75.00 threshold.

Overall, USD/INR is inside a bullish chart formation, descending triangle, which needs confirmation and hence traders will look for key details, like today’s US NFP, for further upside. Until then, bears are likely to keep the reins.

USD/INR weekly chart

Trend: Pullback expected