- Rupee bears take a breather despite the DXY weakness.

- USD/INR set for additional upside looks to regain 74.00.

- The hourly chart appears constructive, 200-HMA key barrier.

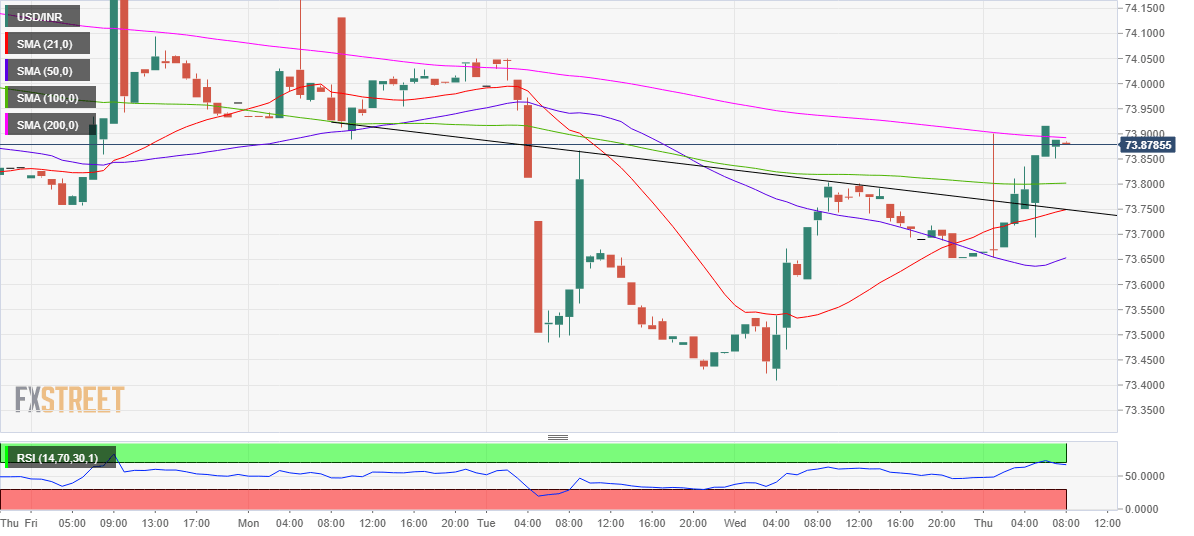

USD/INR stalls its recovery from six-week lows of 73.41 just shy of the 74 level, as the bulls struggle to find acceptance above the critical 200-hourly moving average (HMA) at 73.89.

The two-day recovery rally in the cross picked up pace after the price broke above the three-day-old falling trendline resistance at 73.76.

The spot remains poised for further upside, as the Relative Strength Index (RSI) has eased-off the overbought region while holding firmer around 68.72. A breach of the 74 level remains inevitable, with the 21 and 50-HMA bullish crossover adding credence to the recovery momentum.

On the flip side, the horizontal 100-HMA at 73.80 is likely to cushion the immediate decline. Further south, the confluence of the 21-HMA and the aforementioned trendline resistance now support around 73.75 will be a tough nut to crack for the sellers.

USD/INR: Hourly chart

USD/INR: Additional levels