- USD/INR hits eight-month tops, then retreats.

- Indian rupee bears the brunt of rising covid cases in the country.

- RSI holds above the midline, keeping bulls hopeful.

USD/INR sees a quick retracement from eight-month highs of 75.16, as investors look to take profits off the table after the relentless five-day rise.

The rally in the cross can be mainly attributed to the depreciation of the rupee, courtesy of the rapid rise in the coronavirus infection across the country, which threatens a complete lockdown.

India’s daily COVID-19 cases rose by a record 168,912, totaling 170,719. The Asian nation overtakes Brazil as the world’s second worst-hit country by the virus, with total cases at 13.53 million.

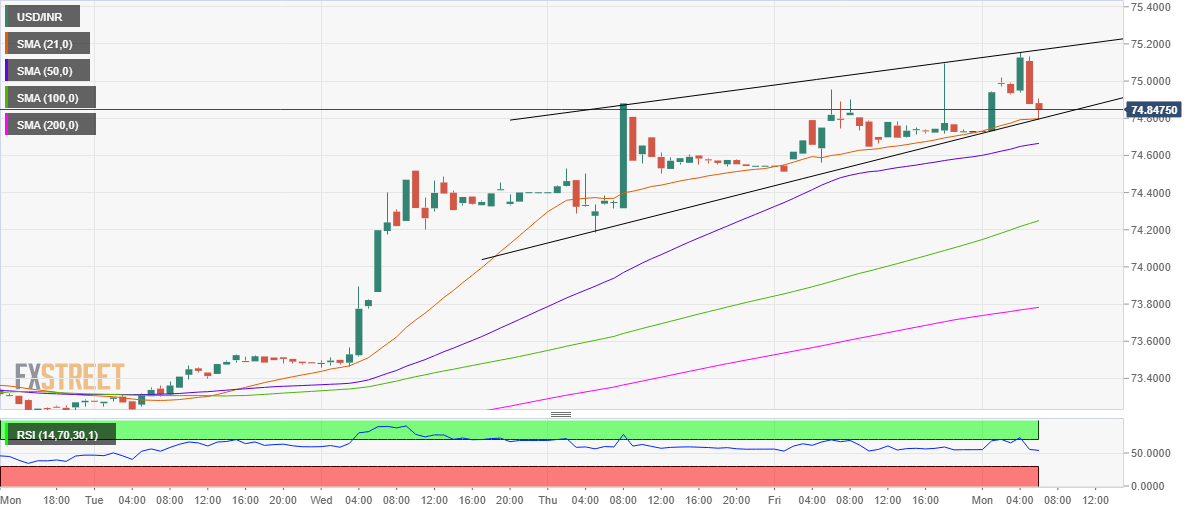

From a near-term technical perspective, the spot’s incredible rise that followed a quick retreat has carved out a rising wedge formation on the hourly chart.

At the time of writing, the price is teasing the wedge breakdown, with an hourly closing below the ascending trendline support at 74.80 to validate the downside break.

Subsequently, a deeper correction towards the upward-sloping 100-hourly moving average (HMA) at 74.25 cannot be ruled out.

Ahead of that level, the 50-HMA at 74.66 could challenge the bearish commitments.

USD/INR: Hourly chart

However, as the Relative Strength Index (RSI) has turned flat while holding well above the midline, the bulls are likely to regain control.

Therefore, a bounce-back towards the 75 mark looks likely, as a retest of the multi-month highs remains on the buyers’ radars.

USD/INR: Additional levels