- INR risk reversals have hit the highest level since mid-December.

- Investors are buying INR puts to position for weakness in the Indian National Rupee.

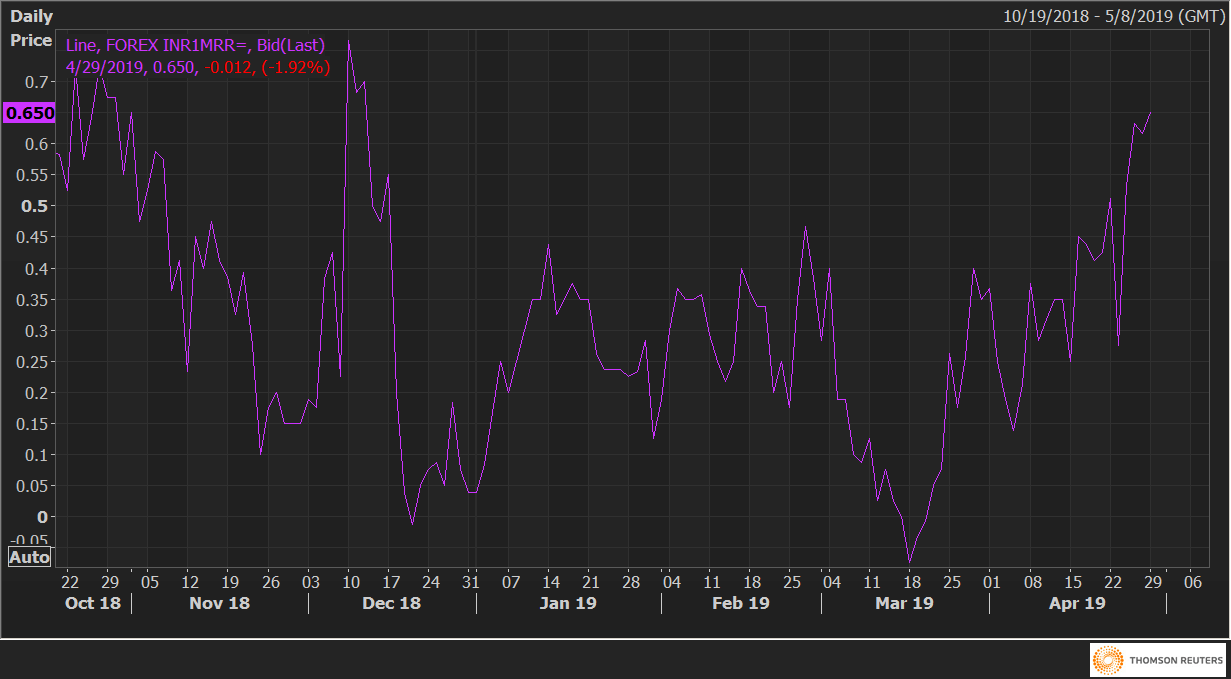

One-month 25 delta risk reversals (INR1MRR), a gauge of puts to calls on the Indian National Rupee (INR), has hit the highest level since mid-December, indicating investors are adding best to position for further weakness in the INR.

Risk reversals are currently seen at 0.65 – a level last seen on Dec. 12. The positive number indicates the implied volatility premium (demand) for the INR put options is more than that for calls.

It is worth noting that the risk reversals were hovering below zero on March 23, representing a stronger demand for the INR call options.

The tide, however, has turned against Rupee over the last five weeks, possibly due to the surge in oil prices. For instance, Brent is currently trading at $71.75, representing an 8.35% gain on lows near $66 seen on March 22. The benchmark hit a high of $75.58 last week.

At press time, USD/INR is trading at 69.77, having bottomed out at 68.38 on April 3.

INR1MRR