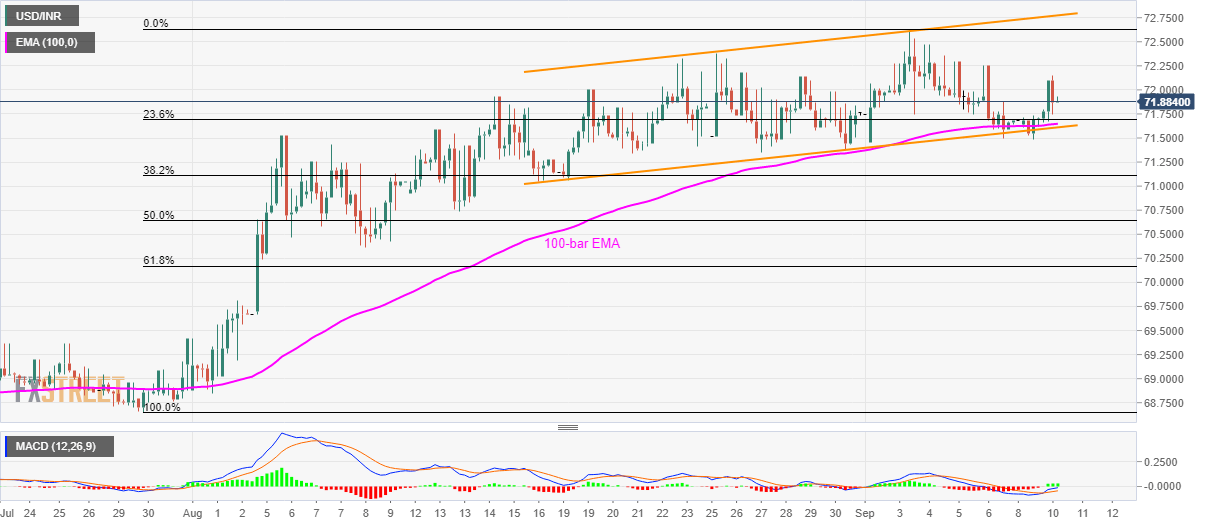

- USD/INR signals further upside with the latest bounce off near-term key supports.

- Sustained break of 71.50 could recall August 13 lows.

- Channel’s resistance-line will question buyers.

The pullback from the 100-bar exponential moving average (EMA) and support-line of three-week-old rising channel portrays the USD/INR pair’s strength as it takes the rounds to 71.90 ahead of Tuesday’s European session.

As a result, buyers will seek a sustained break of 72.30 in order to challenge the monthly top surrounding 72.65. However, channel’s resistance-line near 72.80 and 73.00 round-figure could raise barriers for the bulls.

Meanwhile, a downside break of 71.65/60 support-confluence requires validation from the recent low near 71.50, which if broken could fetch the quote to August 13 bottom close to 70.70.

Should sellers dominate below 70.70, 70.00 round-figure and early-August high close to 69.80 will be on their radars.

USD/INR 4-hour chart

Trend: bullish