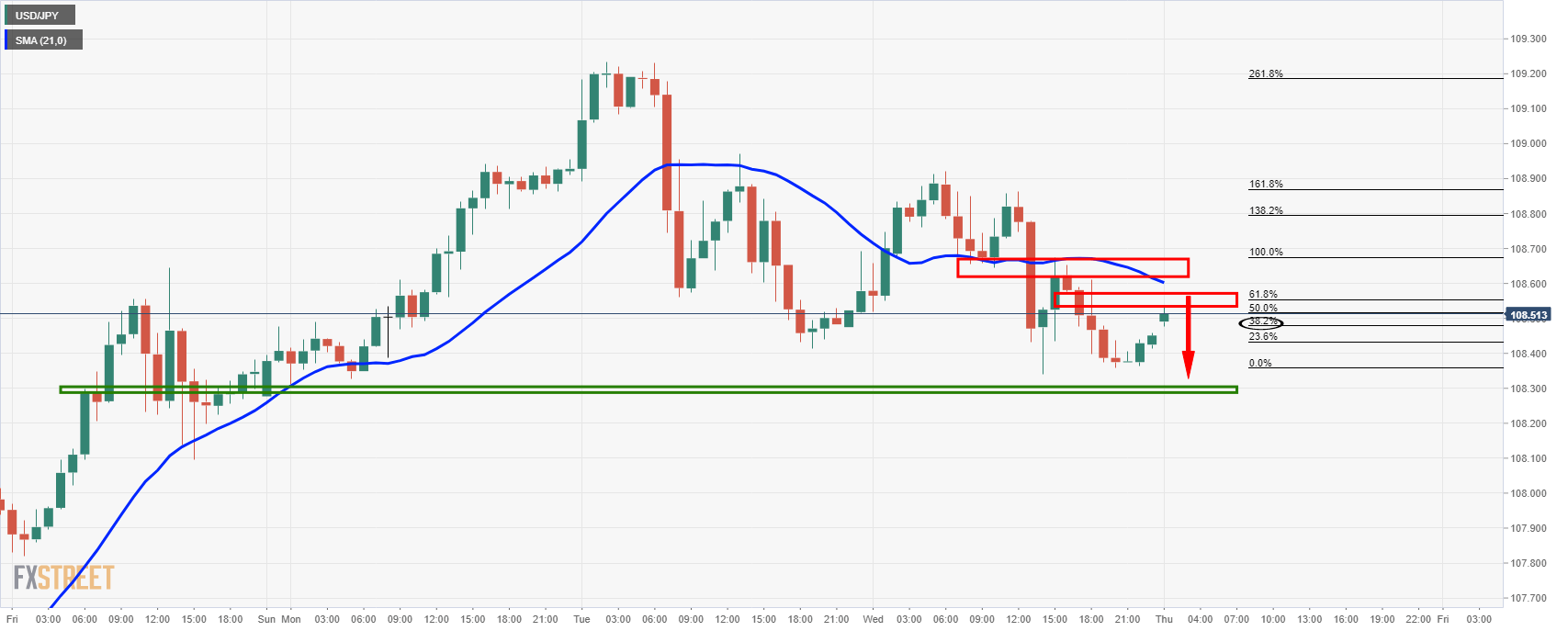

- USD/JPY has eeked out a downside playbook following weakness in the greenback.

- Bears are seeking a downside extension from the 61.8% Fibo.

USD/JPY is currently trading at 108.47 having travelled from a low of 108.34 to a high of 108.49 and is upon the day by 0.11%.

The US dollar index is modestly lower on the day and USD/JPY fell from 108.90 to 108.34.

The US CPI in February rose 0.4% MoM and 1.7% YoY as expected, driven by rising energy costs and cold weather.

However, there was more focus on the core measure, with ex-food and energy up only 0.1% MoM vs the estimate of +0.2% MoM and +1.3% YoY vs the estimated +1/4% YoY.

This lead to US government bond yields moving lower which ended the day slightly lower, despite a softer than expected 10-year Treasury auction results.

The two-year government bond yields held at around 0.16%, and 10-year yields dropped to 1.50% following US inflation data rising less than market expectations.

Investors will now await the auction in 30-year debt on Thursday, seeking to cover massive shorts.

A weak 7-year auction in late February helped fuel inflation concerns and sent yields higher, so investors are keeping a watchful eye on the bond market.

Meanwhile, the markets will also be on the lookout for initial jobless claims that will print around 725k, after ticking higher on weather disruptions last week.

JOLTS job openings are set to hold around 6650, with the recent rise led by business services and retail trade.

USD/JPY technical analysis

The emphasis is on the downside following a correction of the latest bearish hourly impulse.