- USD/JPY volts he 107 big figure as rate cuts a dialled back from market expectations.

- Consumer confidence and stocks take a trip south, leaving the bullish prospects minimal.

USD/JPY shot through to the 107 the figure and reached a high of 107.34 overnight following less dovish rhetoric from a selection of Fed speakers in the New York session. The initial spike came on the back of Fed’s Bullard who stated that a 50 bp cut would be too aggressive in July but advocated for a 25bp cut instead.

This was followed up by Fed’s governor Powell speaking in New York who said, the rate-setting Federal Open Market Committee was “grappling with is whether these uncertainties will continue to weigh on the outlook and thus call for additional policy accommodation,” in prepared remarks. He also stated that the number of tariffs currently in place is not large enough to [directly] have an economic impact, but the uncertainty they bring is impacting the confidence of financial and agricultural markets.

Subsequently, the DXY rammed through the 96 figure and the yen gave back 50 pips in favour of the bulls in USD/JPY which have been bailing out since the end of April in anticipation of Fed rate cuts throughout the year cou0led with deteriorating global economic growth forecasts and endless disputes between the U.S. and its trading-counter-partners, such as China.

Meanwhile, however, there are too many uncertainties for the pair to really find any traction, especially considering the deteriorating backdrop with respect to the yield spread and U.S. rates. Overnight, while the US 2yr treasury yields jumped from 1.70% to 1.76% on the Bullard/Powell comments, they still fell back to 1.73%. The 10yr yield extended its downward trend to 1.98% and markets are still pricing in 33bp of easing at the July meeting (was 36bp yesterday), with a total of four cuts priced by mid-2020, as noted by analysts at Westpac Banking Corporation.

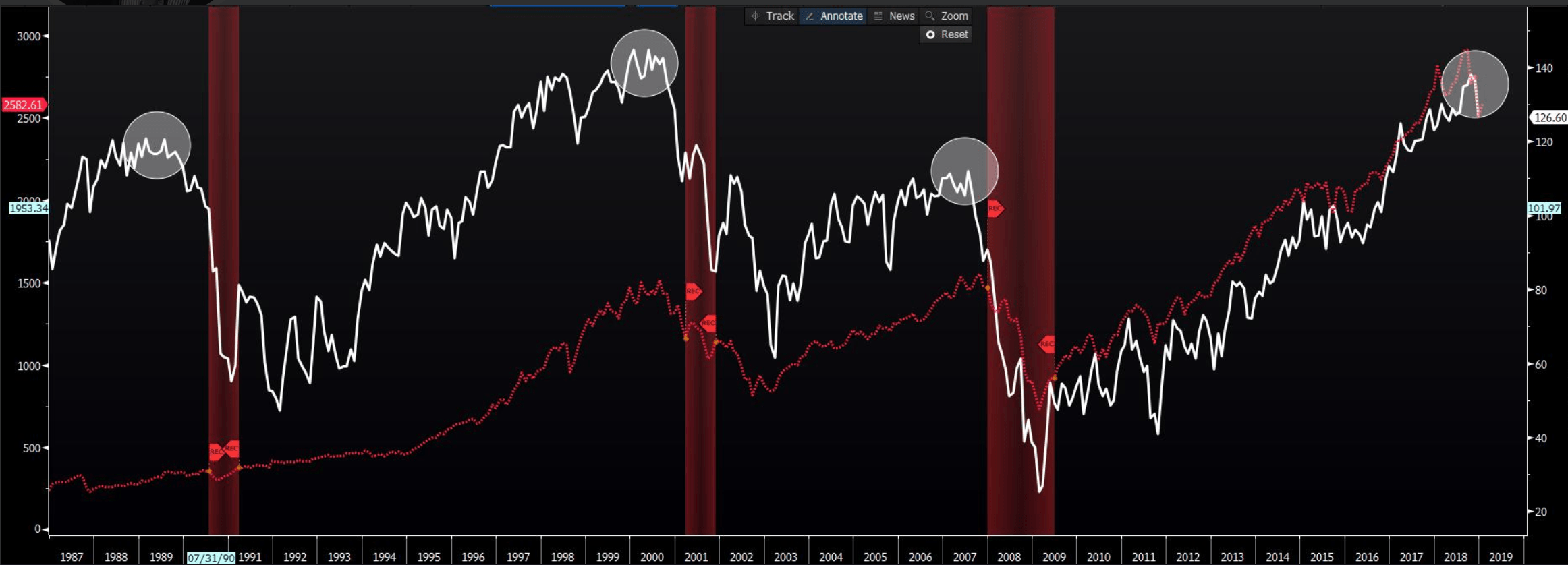

US Consumer Confidence and S&P 500 positive correlation

In the same vein, US Consumer Confidence was disappointing and U.S. stocks were deteriorating. As can be seen in the chart below, there is a strong correlation between U.S. consumer confidence the price of the S&P 500 index, (red), with periods of US recession:

“Consumer confidence in the US fell sharply in June following a downward revision of May data as trade tensions take their toll. The index which measures the current situation fell to its lowest level in 12 months, while the forward-looking index was at its lowest level since January,”

analysts at ANZ Bank explained.

USD/JPY levels

Valeria Bednarik, the Chief Analyst at FXStreet, explained that the USD/JPY posted the fourth daily close between 107.30 and 107.15:

“The trend remains bearish, but the pair shows difficulties in holding far from the mentioned area. Another signal of a not so strong trend move is the fact that it closed far from the fresh 5-month low it reached at 106.76. The daily chart shows the RSI flat under 30 and price well below the 20 SMA (108.30) with no immediate risk to the bearish outlook. Ahead of the Asian session, the pair seems consolidating but still unable to reclaim the 20 SMA in the four hours chart at 107.25. The US dollar is likely to face resistance between 107.25 and 107.50. A slide back under 107.00 will increase the bearish pressure, exposing Tuesday’s lows and 106.50.”