Dollar/yen advanced just a bit within well-known ranges but never went too far. The approval of the tax bill was priced in while rising US treasuries sent the pair higher. The data proved mixed. The holiday week consists of a few US publications as well as a speech by BOJ Governor Kuroda.

USD/JPY fundamental movers

Tax cuts, mixed data and rising bond yields

The massive tax cuts were approved by both chambers of Congress and were signed into law by President Donald Trump. The smooth sailing was already priced in after the Senate made the big move in the previous week. We saw some “sell the fact” reaction.

US data was mixed: GDP growth was revised down to 3.2% in Q3, a minor shift. Durable goods orders missed expectations while housing data was looking great.

Yet while the dollar lost some ground against many other currencies, the rising US bond yields supported the greenback against the yen. Will this continue? A lot depends on inflation developments.

In Japan, the BOJ made its rate decision and finished it up quite early, not rocking the boat at all. Perhaps the really big gathering is only in April.

Consumer confidence, Kuroda, and holiday trading

Many market participants are off in the 3 trading days after Christmas, but we still have a few events that can move the markets: the CB consumer confidence, pending home sales and the Chicago PMI stand out. In Japan, BOJ Governor Kuroda will have a shot at moving the yen in a scheduled speech on Tuesday at 4:00.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

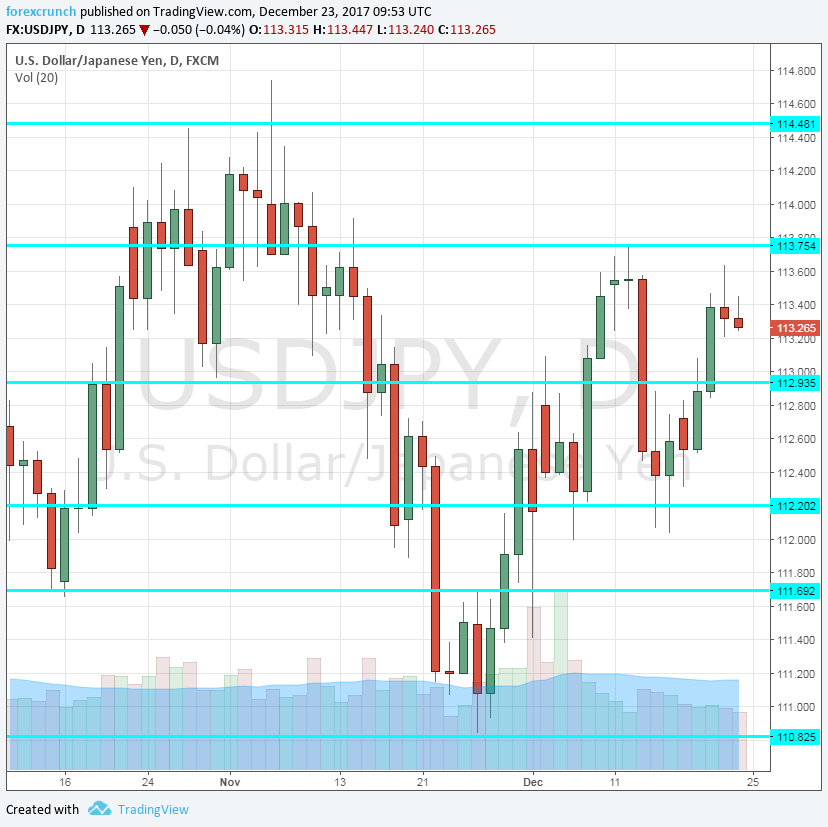

115.35 is an old line that served as support when the pair traded on higher ground. 114.50 is the cycle high last seen in early July. The pair got close to that level.

113.70 was a separator of ranges in June and a line of resistance in December. It caps the range. 112.90 served as support in December and is a pivotal line in the range.

112.20 used to be important in the past. It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance.

USD/JPY Daily Chart

USD/JPY Sentiment

I am neutral on USD/JPY

The pair is getting comfortable in a limited range and this is unlikely to change around Christmas. We can expect a potential fall in 2018, but not yet.

Our latest podcast is titled A December to remember for EUR/USD

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!