Dollar/yen extended its downfall, trading at the 110 level but not going lower so far. The dollar’s weakness was felt in this pair and so did the attempts to recover. Will it continue lower? We have key events in the US and a rate decision by the BOJ.

USD/JPY fundamental movers

Mixed data and a government shutdown

Housing starts and building permits were quite mixed and consumer sentiment missed expectations. The dollar made some attempts to recover, as the Fed seems keener on raising rates, with a notable upbeat speech from Kaplan.

Yet the biggest market mover came from the political scene. A side story of a government shutdown turned into reality after markets closed. Lawmakers were unable to get a deal and they continued the blame game over the weekend. Will this continue weighing on the dollar?

BOJ decision, initial US GDP and more

The Bank of Japan convenes for the first time after making that “mini taper tantrum”. Will they begin signaling the end of QE? This is very unlikely, especially given the recent strengthening of the yen. They may wait for April or most probably, for a few more years.

In the US, the government shutdown story will continue rambling, but then we have existing and new home sales releases. The big event is on Friday: the first release of US GDP for Q4, which is expected to continue the positive streak, with a rise of 3%.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

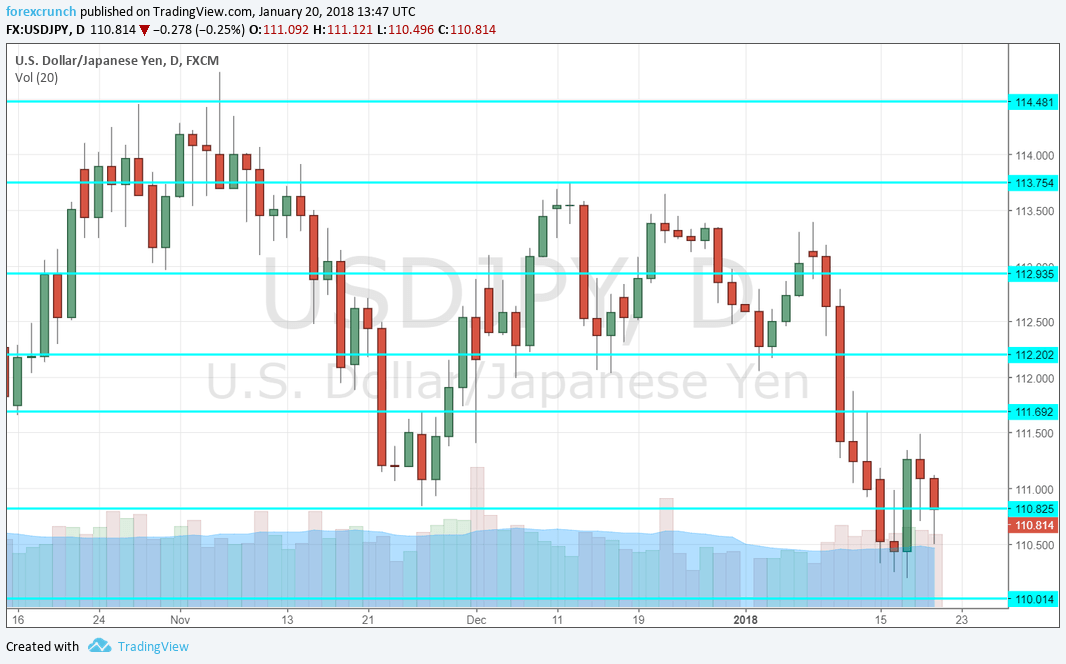

114.50 is the cycle high last seen in early July. The pair got close to that level. 113.70 was a separator of ranges in June and a line of resistance in December. It caps the range.

112.90 served as support in December and is a pivotal line in the range. 112.20 used to be important in the past.

It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance. Even lower, we find 107.10 as the ultimate level.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

With the US government shutdown and flows going out of the US to riskier assets, the pair has more room to the downside.

Our latest podcast is titled Oil on a roll and some bitcoin bashing

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!