Dollar/yen dropped gradually as trade tensions between China and the US triggered safe-haven flows to the yen, something that has always been seen this summer. Will it continue down? US retail sales stand out and the pair will likely follow bonds and stocks once again.

USD/JPY fundamental movers

Turkish crisis, tariffs, Japanese GDP, US inflation

The pair ended the week lower on safe-haven flows stemming from the Turkish crisis. The fall of the Turkish Lira causes risks to European banks and this made the crisis global. The yen reasserted itself as a safe-haven currency after the recent decision by the Bank of Japan and it was evident in this episode.

The mood was already somewhat edgy as the US announced it would impose further tariffs on China on August 23rd. These new duties are on $16 billion worth of Chinese goods and came as no surprise. Nor did China’s retaliation. The next move is much bigger: on $200 billion of goods, expected on September 6th. There is still time for negotiations.

The BOJ was challenged by markets that wanted to see how high yields would go. The central bank wants easier lending conditions but also wants banks to make a profit.

Japanese GDP came out at 0.5% q/q in Q2, above expectations and also supported the yen. In the US, Core CPI came out at 2.4% y/y, above expectations.

All in all, global news has a broader impact than economic data.

US retail sales, JGB’s, and trade

Japanese 10-year yields will remain of interest once again. A lower value means a lower yen and an increase will push the currency higher.

Trade issues are also in the headlines. While no significant development is expected, there are always surprises when it comes to the US President.

Data-wise, the US consumer is in the limelight. Retail sales, published on Wednesday, are the primary event of the week. Increases are projected on all measures. The University of Michigan’s consumer sentiment on Friday is also of interest.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

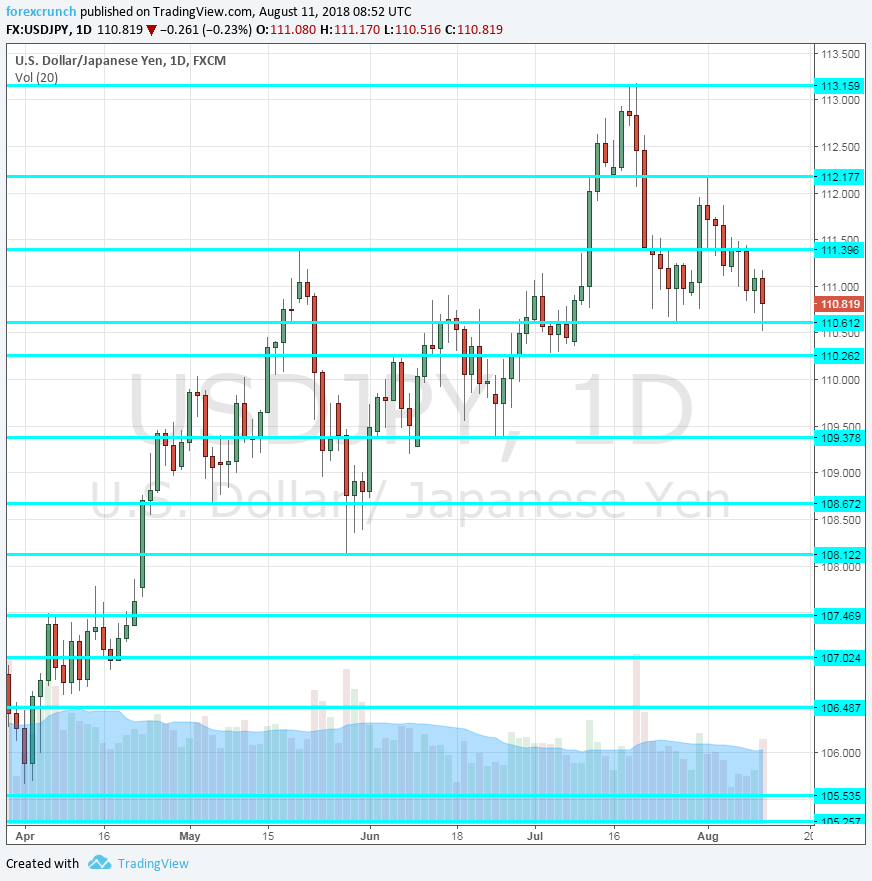

113.15 is the high point seen in July. 112.20 was a swing high early in the month.

It is followed by 111.40 which capped the pair in mid-May. 110.60 supported the pair in late July and early August.

Further down, 110.25 provided support in early July. 109.30 was a low point around late June. 108.70 was a stepping stone on the way up. 108.10 was a low point in late May and serves as a support line.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The safe-haven yen narrative is in full swing and there is enough trouble in the world to keep it going.

Our latest podcast is titled Brexit summer blues, trade troubles

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!