Dollar/yen dropped for a second week in a row but did not go anywhere fast. The pair now faces rate decisions by both central banks.

USD/JPY fundamental movers

Trade truce, upbeat US growth

Donald Trump changed his stance on trade, at least for now. After tweeting that tariffs are great, he agreed with EU Commission President Jean-Claude Juncker to negotiate lower tariffs and in any case, not impose new tariffs during the talks. Alongside progress on NAFTA, the markets enjoyed the better mood.

The US economy grew by 4.1% annualized in Q2 2018, the fastest clip in four years. However, the figure was hyped by Trump and the reaction in markets was a small slide in the US Dollar. The strong figure still gives the Fed the necessary backwind to continue raising rates.

In Japan, the BOJ bought bonds to lower the 10-year yield after markets had tested it.

Fed, BOJ, NFP

This Bank of Japan decision is more important than the previous ones. The reduction in bond-buying by the BOJ has led to speculation of a “stealth tightening” of monetary policy. However, they are too far from the inflation goal of 2% and tightening is not really on the cards.

The Fed is also unlikely to change its monetary policy. The meeting does not consist of a press conference nor new economic projections. The focus is on the statement, where Powell and co. are predicted to cheer the recent GDP data. Comments on inflation will also be of interest.

The Non-Farm Payrolls published on Friday always gather attention. Wages disappointed last time with only 2.7% y/y and 0.2% m/m. No big changes are expected now.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

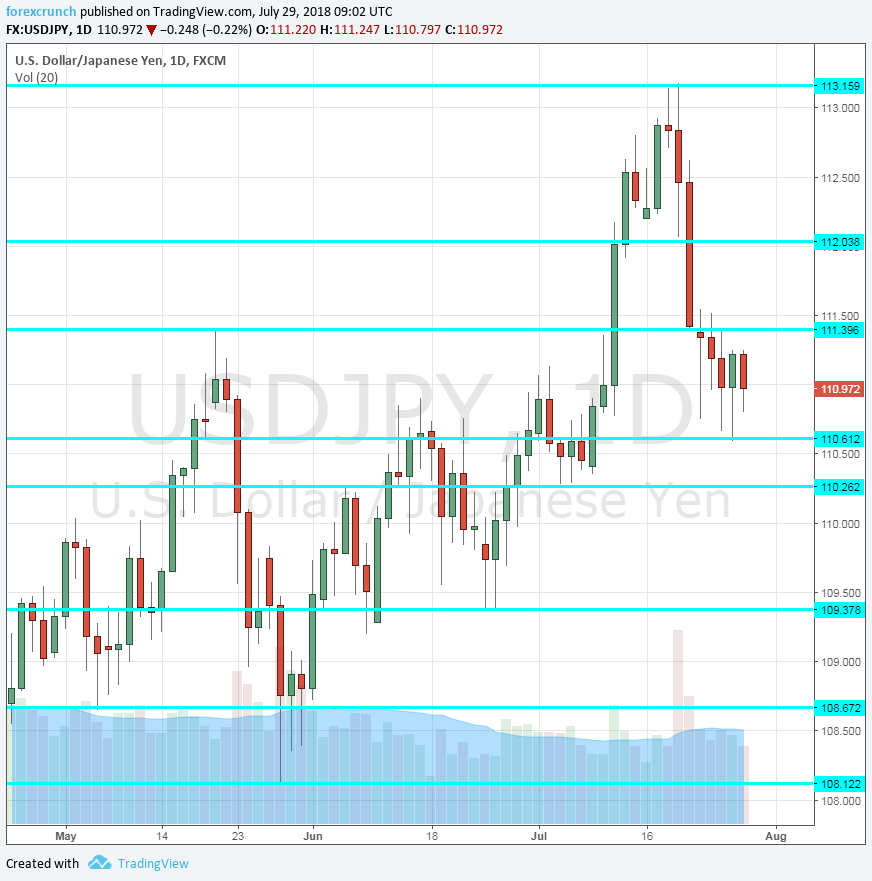

114.75 capped the pair back in October and remains a high point. 113.75 capped the pair later in late 2017.

113.15 was the high point in July. The round number of 112.00 provided support to the pair when it was trading on high ground.

It is followed by 111.40 which capped the pair in mid-May. 110.60 was a trough in late July.

Further down, 110.25 provided support in early July. 109.30 was a low point around late June. 108.70 was a stepping stone on the way up. 108.10 was a low point in late May and serves as a support line.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bullish on USD/JPY

Monetary policy divergence is the name of the game. The BOJ is set to remind us that its policy is extremely dovish while the Fed is hawkish. This could lead to gains for the pair.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!