Dollar/yen surged in a week that saw the US Dollar reign supreme and when the safe-haven status of the yen lost its meaning. What’s next? The testimony by Powell, US retail sales, and other events are set to rock the pair.

USD/JPY fundamental movers

Powell sleeps well, trade wars are limited, inflation is rising

Fed Chair Jerome Powell gave an unexpected interview in which he said he “sleeps well at night” when it concerns the economy. Together with higher inflation (2.3% on the core as expected). The picture is upbeat for the US Dollar.

The greenback also gained on the growing trade wars, surprisingly also against the safe-haven yen and the Swiss franc, which seem to have lost their shine. USD/JPY made a major break to the upside.

The US is readying a list of $200 billion worth of Chinese goods to impose tariffs on. The actual move is projected to happen at the end of August, but markets were shaken by the news. On the other hand, reports about renewed negotiations between the sides helped calm the atmosphere and allowed the pair to surge.

Powell again, Putin, and retail sales

The main event of the week is Powell’s semi-annual testimony in front of Congress. The release of his prepared statement on Tuesday will likely have the biggest impact. Further comments on trade may have a significant impact after those have been muted so far.

The Summit between US President Trump and his Russian counterpart Putin is of interest, but it may have a limited market impact on Monday. However, US retail sales, published on the same day, will likely rock markets.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

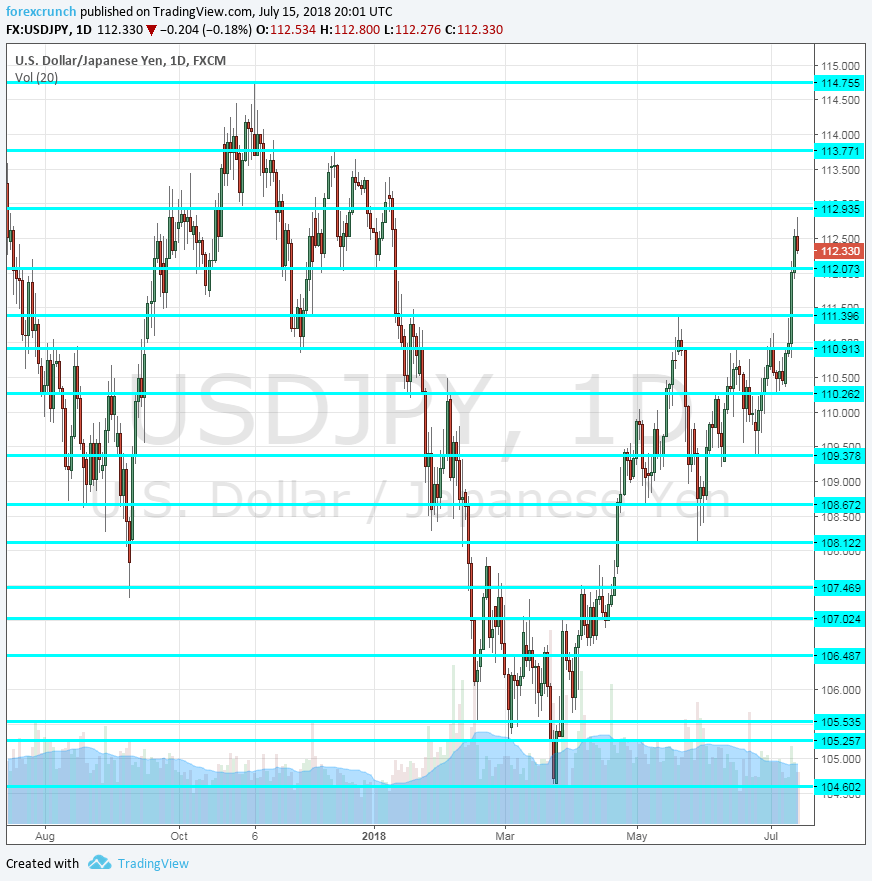

114.75 capped the pair back in October and remains a high point. 113.75 capped the pair later in late 2017.

It is followed by 112.80 which capped the pair in mid-July. The round number of 112.00 provided support to the pair when it was trading on high ground.

It is followed by 111.40 which capped the pair in mid-May. Further down, 110.90 was a high point in February.

Further down, 110.25 provided support in early July. 109.30 was a low point around late June. 108.70 was a stepping stone on the way up. 108.10 was a low point in late May and serves as a support line.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am neutral on USD/JPY

Even if the yen lost its safe-haven appeal, the recent rise puts it in overbought territory, allowing for a correction.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!