Dollar/yen made a cautious move to the upside as trade war fears were subsided quite quickly. Can this last? A busy start to the week features the FOMC Minutes, the NFP, some surveys from Japan, and the recurring theme of trade wars.

Markets reacted with a shrug to the US tariffs on China and the counter-duties by the world’s second-largest economy.

Join a live coverage of the US NFP.

USD/JPY fundamental movers

Some relief in the trade wars

The Trump Administration made threats against the EU early in the week but markets later cheered the move to allow an independent institution to monitor Chinese investments, a move that seemed like a softening of his stance. This helped remove flows to the safe-haven yen.

US data was mixed. The final GDP disappointed with 2% annualized growth while the Core PCE surprised with a move to 2%, the Fed’s target. Durable goods orders missed on the core but came on top of upward revisions.

Japan’s Tokyo inflation report surprised to the upside on all measures, including the all-important figure that excludes fresh food. This did not help the Japanese yen.

FOMC minutes, full FOMC buildup and some Japanese data

The first week of the month and the quarter opens with a full buildup to the Non-Farm Payrolls. The ISM Manufacturing PMI on Monday is followed by the ADP NFP and the ISM Manufacturing on Thursday, all leading to the big release on Friday. The NFP is expected to result in a “more of the same” publication: around 200K jobs gained and a monthly wage growth of 0.3% in June, identical to that in May.

In addition, Thursday sees the publication of the all-important FOMC Meeting Minutes for the hawkish hike seen in June. The Fed signaled two additional interest rate raises in 2018 and Fed Chair Powell sounded very optimistic about the economy. It will be interesting to see if the lengthy document includes insights about trade relations. If the Fed expresses concerns, markets can suffer.

See all the main events in the Forex Weekly Outlook

Update: The US ISM Manufacturing PMI came out at 60.2, better than expected.

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

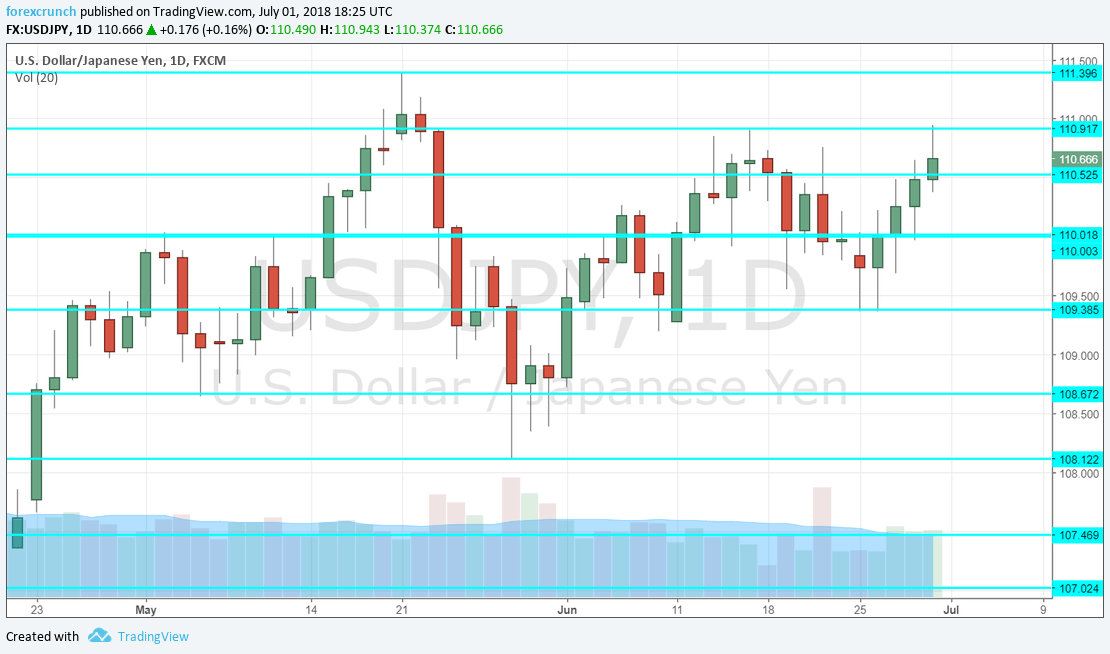

112.20 supported the pair back in December. It is followed by 111.40 which capped the pair in mid-May.

Further down, 110.90 was a high point in February. The round number of 110 serves as a psychological level. 109.30 was a low point during two days in June.

109 was a pivotal line within the range. 108.70 was a stepping stone on the way up. 108.10 was a low point in late May and serves as a support line.

Lower, we find 107.50 capped the pair in early April and is a strong line.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

Trade wars have not gone away and the imposition of tariffs could hit the pair hard. The yen attracts safe haven flows.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!