Key news updates for USD/JPY

Updates:

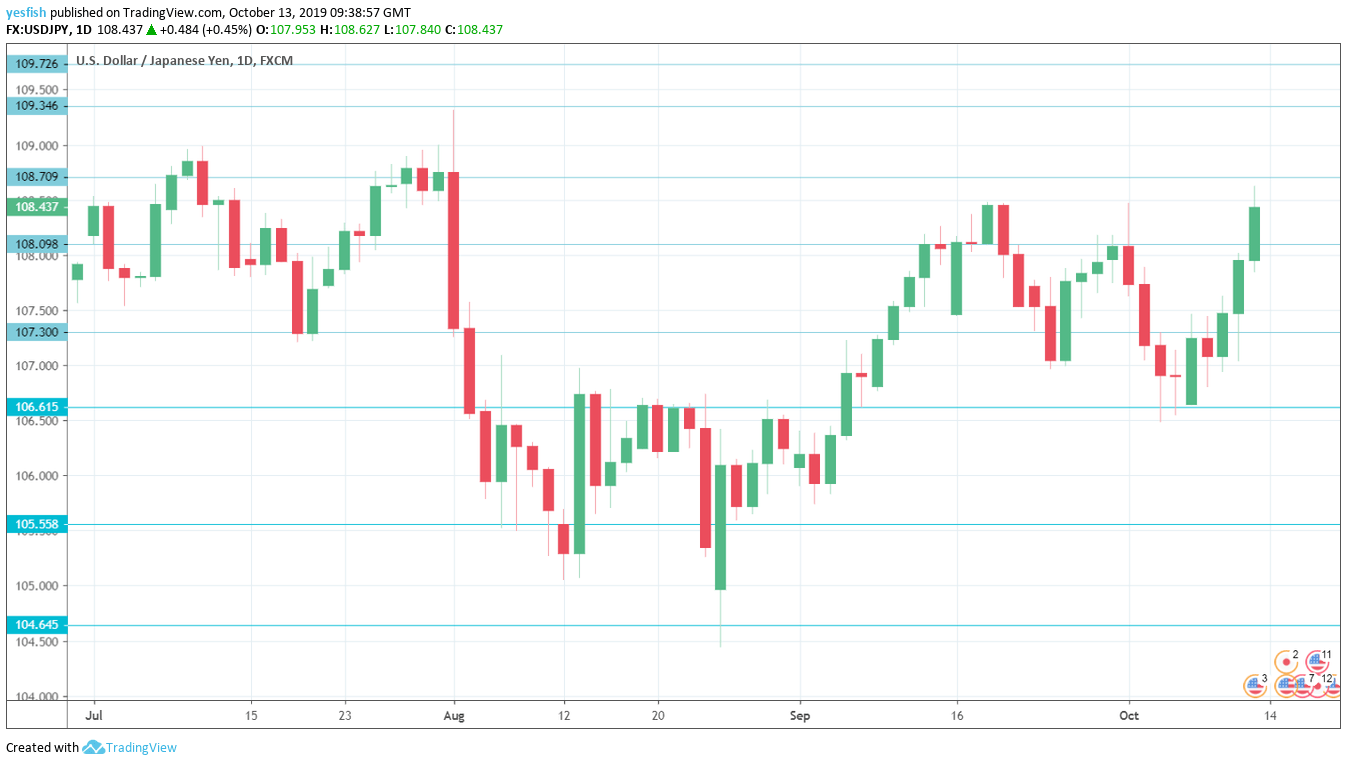

USD/JPY Technical Analysis

We start with resistance at 111.62, which was last active in April. 110.62 is next.

109.73 has held in resistance since the end of May. 109.35 is close by.

108.70 has weakened and is an immediate resistance line.

108.10 switched to a resistance role late in the week, after USD/JPY posted gains.

107.30 has some breathing room in support.