Key news updates for USD/JPY

Updates:

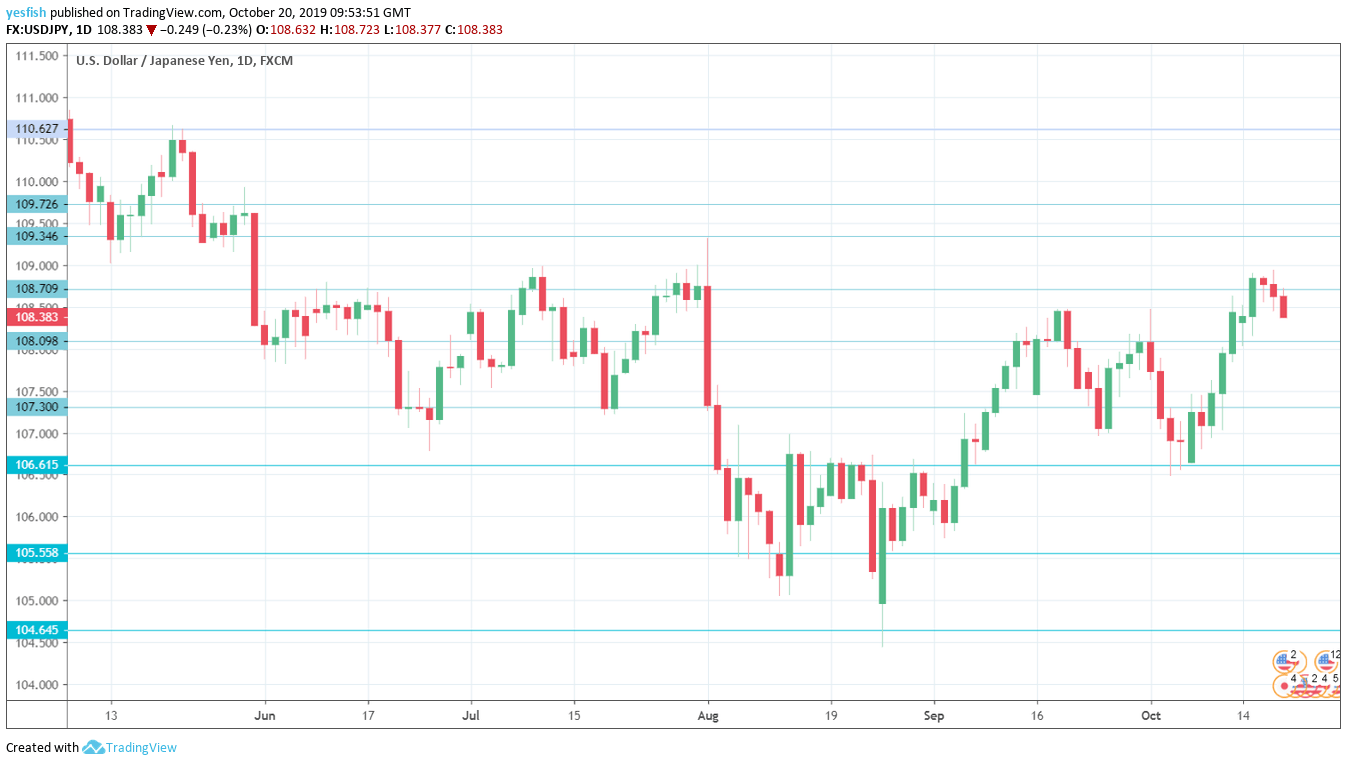

USD/JPY Technical Analysis

We start with resistance at 111.62, which was last active in April. 110.62 is next.

109.73 has held in resistance since the end of May. 109.35 is close by.

108.70 remains an immediate resistance line.

108.10 remains relevant and has switched back to a support role.

107.30 has some breathing room in support. This line switched to support in early October, at the start of the most recent dollar rally.