Dollar/yen continued its march to the upside as the US went forward with announcing trade tariffs and US yields advanced towards the highs. The Fed decision is left, right, and center.

USD/JPY fundamental movers

Trade taken with a stride, higher US yields

The US announced a 10% tariff on $200 billion worth of Chinese products. The move was well-telegraphed and the duty of 10% is at the lower range of expectations. A relatively muted response from China, which retaliated in a limited manner, also helped soothe investors. Markets remained calm and the yen was not in high demand.

An increase in US bond yields supported the greenback. The benchmark 10-year yield topped 3% and other maturities also moved forward. This explains the increase.

The Bank of Japan left its policy unchanged as expected and did not provide any hint of any future tightening, not adhering to PM Shinzo Abe’s talk that loose monetary policy is not here forever. Abe won the internal contest in the ruling LDP party and will remain PM as expected.

All about the Fed

The Fed makes its decision on Wednesday and will raise rates, as it signaled over and over again. They will likely maintain their intentions to raise rates once again this year, in December. But what’s next? Will the Fed make the full shift from accommodative to tight monetary policy? A lot depends on the dot-plot that the Fed publishes but the statement still matters. Fed Chair Jerome Powell will provide the additional excitement.

In Japan, the fresh Tokyo CPI data for September will be of interest but no significant rises are expected.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

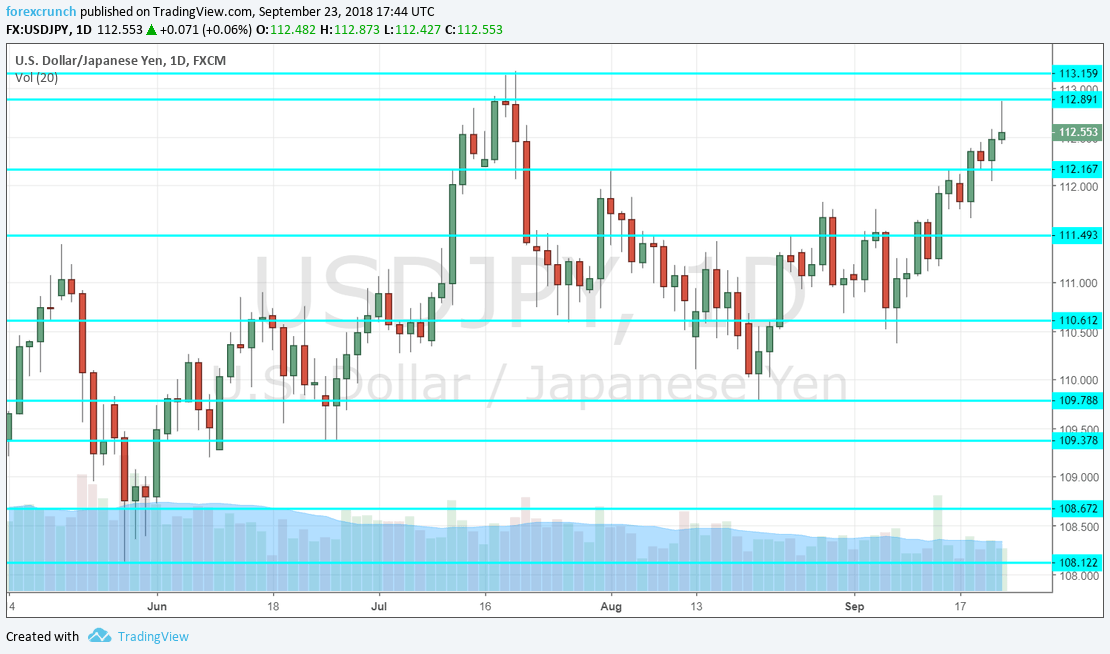

113.15 is the high point seen in July. 112.80 held the USD/JPY down in mid-September. 112.45 was a stepping stone for the pair when it traded on such high ground. 112.15 was a swing high early in the month.

111.80 was a peak in the dying days of August and serves as resistance. Close by, 111.50 capped the pair beforehand and is another barrier.

110.60 was a swing low in late July and then again in late August. 109.70 was a swing low in late August and provides extra support below the round 110 level.

Close by, 109.35 was a cushion in mid-July. 108.70 was a cushion early in the summer and 108.10 a swing low in late May.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bullish on USD/JPY

At least for now, the Fed will likely remain hawkish and upgrade its forecasts, giving the greenback another leg higher.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!