Dollar/yen wobbled amid a barrage of news related to trade: NAFTA, China, and also Brexit all played a role in rocking the pair. The upcoming week features top-tier figures such as the Non-Farm Payrolls and also new US tariffs on China.

USD/JPY fundamental movers

Trade tensions, upbeat US figures

The week began with optimism related to NAFTA. The US and Mexico reached an accord between them and Canada was set to join. However, intense talks with Canada did not go very far. While negotiations continue, the lack of a deal weighs on sentiment.

US President Donald Trump said he wants tariffs on China as soon as possible and also complained against the EU. His tough stance also caused worries. On the other hand, optimism about a Brexit deal improved the mood.

US GDP was upgraded to 4.2% annualized and the CB Consumer confidence hit the highest levels since the year 2000. On the other hand, yet another housing figure missed expectations.

In Japan, the Tokyo inflation figure surprised to the upside but remains depressed and far below the 2% target the BOJ aims for.

NFP Buildup and a serious escalation in trade

The first week of September starts with a holiday in the US but warms up quickly. The ISM PMI’s and the ADP NFP are set to move markets and also serve as hints to the Non-Farm Payrolls report on Friday. After a disappointing increase in July, a return to normal levels is expected in August. Wage growth is projected to accelerate to 2.8%.

The looming trade war with China is set to steal the headlines. The deadline for public comments on new tariffs ends on September 6th. After hitting China with duties on $50 billion worth of Chinese products, Trump wants to slap levies on an additional $200 billion of goods. China will be unable to retaliate in kind and may include non-tariff measures. The significant escalation will have an effect on other economies as well as the world is much more connected.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

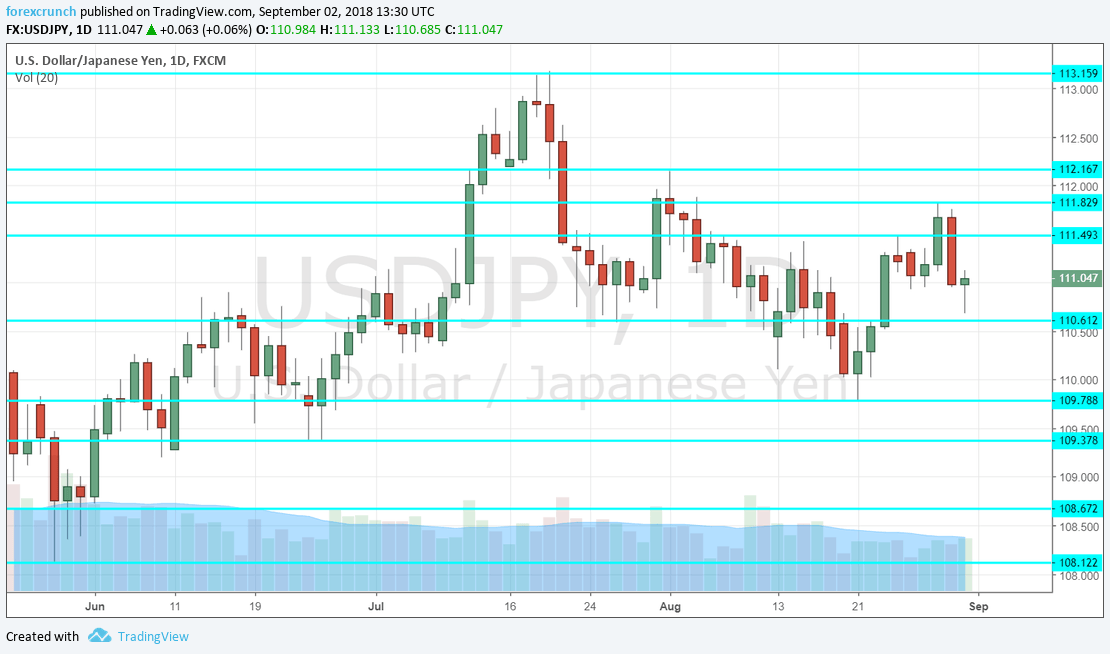

113.15 is the high point seen in July. 112.15 was a swing high early in the month.

111.80 was a peak in the dying days of August and serves as resistance. Close by, 111.50 capped the pair beforehand and is another barrier.

110.60 was a swing low in late July and then again in late August. 109.70 was a swing low in late August and provides extra support below the round 110 level.

Close by, 109.35 was a cushion in mid-July. 108.70 was a cushion early in the summer and 108.10 a swing low in late May.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

Unless there is a last-minute delay or deal, the US will substantially escalate the trade war with China, disrupting the global economy. The move can push funds into the safety of the yen. US data may be upbeat, but the Fed will raise rates in any case later in the month.

Our latest podcast is titled Brexit summer blues, trade troubles

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!