Key news updates for USD/JPY

Updates:

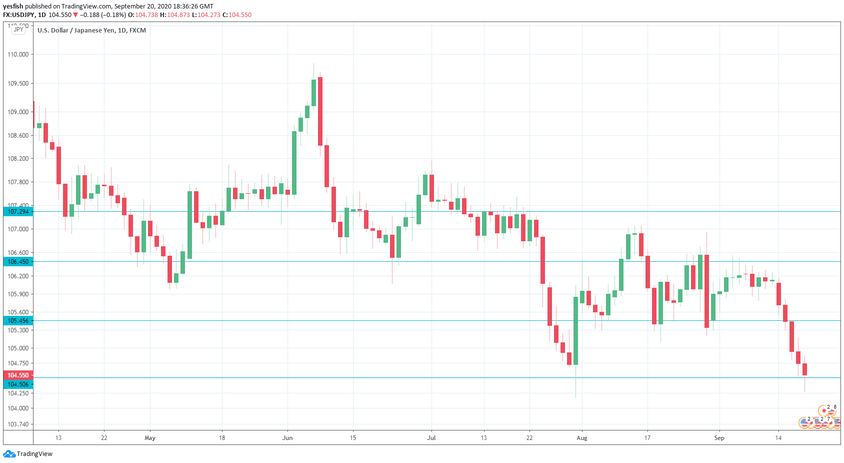

USD/JPY Technical Analysis

With USD/JPY dropping sharply, we start at lower levels:

107.29 (mentioned last week) is protecting the 107 level.

106.44 is next.

105.45 has switched to a resistance line after sharp losses by USD/JPY last week.

104.50 was tested in support late last week. It is a weak line.

103.52 has held in support since March.

102.13 is the final support line for now.