- US Stocks indices are currently rebounding near 3-month’s low diminishing the demand for the safe-haven Japanese Yen.

- Greenback bulls are starting to look at 114.00 figure as the next main target to the upside but 113.00 figure must be clearly broken on a daily closing basis.

USD/JPY is trading at about 113.15 up % on Monday as the US Dollar is strengthening across the board.

USD/JPY is gaining steam and rising to its hights level since last Wednesday as the US Stock indices are currently rebounding from 3-month’s low. As the market is back in risk-on mode, market participants generally get rid of the Japanese Yen, therefore helping the USD/JPY to go up.

Additionally, also compounding USD/JPY strength, is the slight intraday uptick in US yields. In fact, the 10-year benchmark Treasury note yield is trading at about 2.85% on the first day of the week.

On the broader perspective, the Greenback is also getting an intraday boost against EUR and GBP as Brexit and UK political concerns intensify.

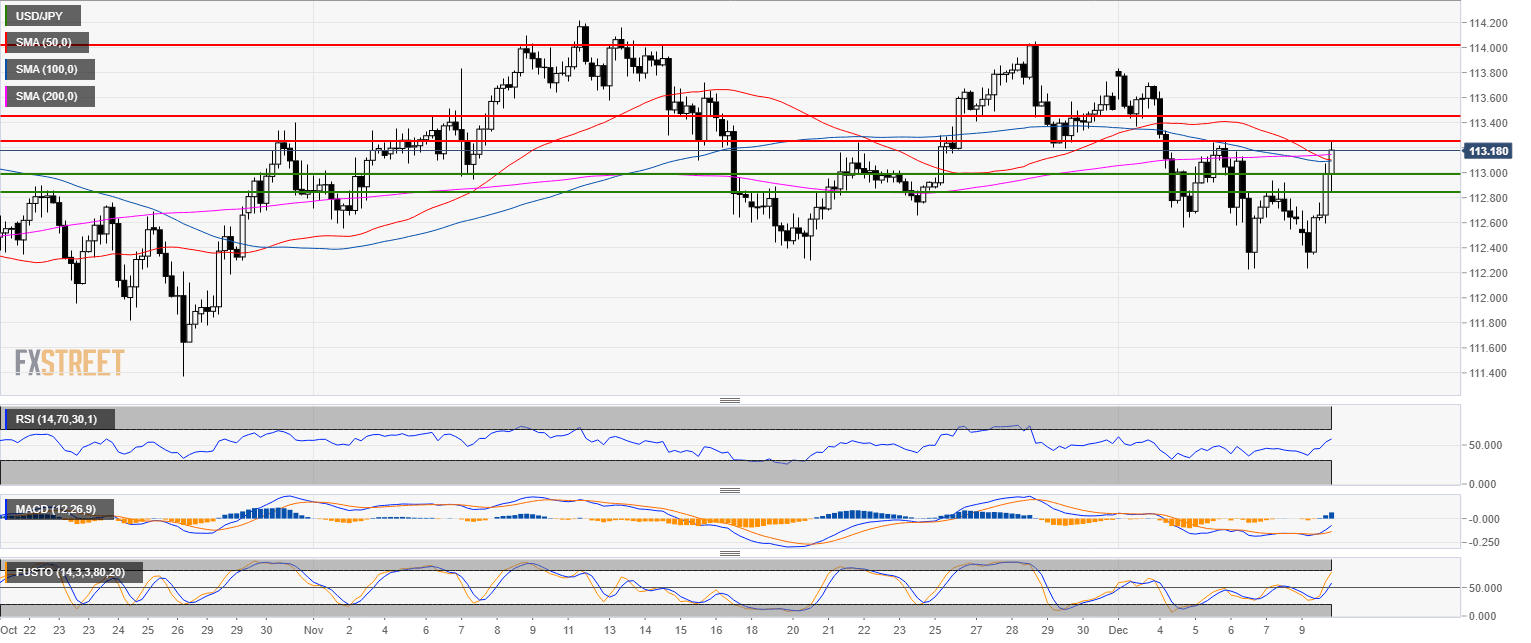

On the technical picture, the level to beat for bulls in the short-term is the 113.25 resistance followed by 113.45 and finally 114.00 figure. The momentum is bullish with the technical indicators in positive territories however bulls will need to move beyond the cluster of simple moving averages. To the downside, investors can expect some degree of support at 113.00 figure and a stronger one near the 112.85 level.

USD/JPY 4-hour chart