- The USD/JPY turned sharply lower as fear gripped markets.

- The US Non-Farm Payrolls and GDP stand out, but geopolitics may continue moving markets

- The technical picture is turning more bearish after the recent fall.

Risk off is back

A week that began with optimism about trade talks saw the mood significantly worsen.

North Korea: The most substantial development was the announcement by US President Donald Trump that the Summit with North Korean Leader Kim Jong-un was off. There were some warning signs. North Korea was angered by American talk of applying the “Libya model.” The Ghadaffi regime did not end well. Some of the preparatory talks were canceled, and a North Korean official called Vice President Pence a “political idiot.” The calling off of the event still caught markets by surprise and sent the USD/JPY lower on safe haven flows. There is still hope as North Korea said it is willing to meet the US at any time.

Trade: The week began with optimism after the US and China agreed to hold off the trade wars. However, things deteriorated fast with Trump expressing dissatisfaction about talks with the world’s second-largest economy. Also, the Administration is considering imposing new tariffs on imported cars, a move that could dampen global trade. Exemptions for the EU on steel and aluminum tariffs is still in the air. Fears of less trade also boosted the Japanese yen.

Fed expectations: The pair also suffered from standard, monetary policy news. The Meeting Minutes from the Fed included a thick hint that the team led by Chair Jerome Powell is set to raise rates in June, confirming markets expectations. On the other hand, they are willing to tolerate somewhat higher inflation. The minutes clarified the wording about a “symmetric inflation target” that appeared in the recent rate statement and is a hint that the Fed may wait for a more extended period before increasing rates once again. The central bank is now more likely to stick to the plan to raise rates three times in 2018, as it appears in the dot-plot, and not four times.

US data: Figures released during the week were slightly missed expectations, with Existing Home Sales slipping to 5.46 million annualized and New Home Sales dropping to 662,000 annualized. Jobless claims also disappointed with an increase to 234,000. Nevertheless, these were small misses in second-tier figures.

Japanese inflation: The fresh inflation figures for Tokyo in May showed that excluding fresh food, prices rose by only 0.5% YoY, below expectations. Inflation is nowhere to see. The Bank of Japan will likely leave its ultra-loose monetary policy unchanged for a very long time.

All in all, worries about the Korean peace process, worries about trade and a potential slowdown in the Fed’s path of interest rate hikes sent the pair lower.

US events: NFP, GDP, and the Fed’s favorite inflation measure

The week begins slowly, with the S&P Case Shiller HPI on Tuesday likely to provide robust data on the US housing market. Things quickly warm up.

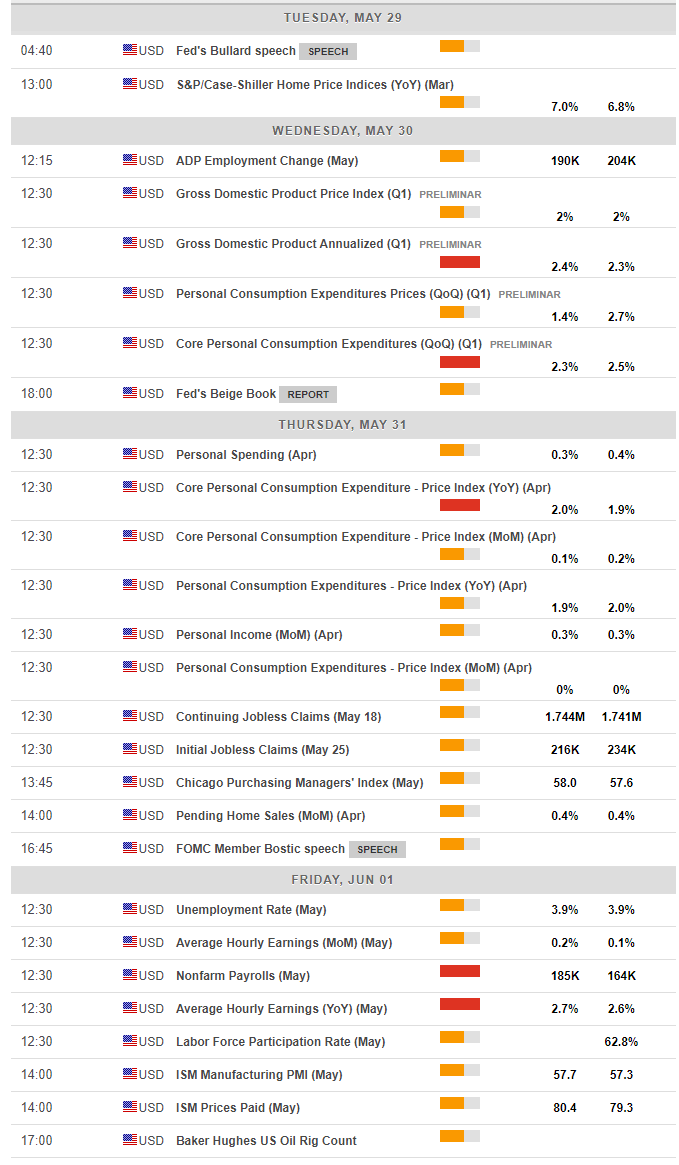

The ADP Non-Farm Payrolls on Wednesday provide the sole hint towards the official BLS NFP on Friday. A gain of 190,000 private sector positions is expected for May after 204,000 in April – an ongoing steady increase in the US labor market. Markets will not have more than 15 minutes to digest the data as an update for GDP growth is due shortly afterward.

The initial release showed an annualized growth rate of 2.3% at the start of 2018, below previous quarters but better than previous kick-offs to the year and far above the meager figures in the euro-zone and in the UK. A small upgrade to 2.4% is on the cards, serving as a reminder that the US stands out in faster growth. Apart from the headline measure, markets will want to see personal consumption as a prominent component in the report and will brush off any enhanced contribution by inventories, which tend to be depleted after they are replenished. Later in the day, the Fed’s Beige Book could shed some further light on the economic situation.

The Core PCE Price Index is the highlight of Thursday as it is the Federal Reserve’s favorite inflation measure. In April, the annual pace of core inflation rose to 1.9%, just below the Fed’s target of 2%. Projections point to 2% for May, even though the parallel Core CPI figure remained unchanged in the read for the same month. Reaching 2% would certainly be encouraging for the central bank.

Alongside the Core PCE, Personal Spending and Personal Consumption are expected to continue rising at solid paces. The Chicago PMI is predicted to extend its run of upbeat figures around last month’s 57.6 points, reflecting robust growth. Thursday is May 31st, the last day of the month, and we may some last-minute end-of-month flows which may trigger choppy trading.

And the best is kept for last: Non-Farm Payrolls on Friday. The jobs report for April disappointed with the US economy gaining 164,000 positions, below the averages of around 200,000. A gain closer to the norm is on the cards now. Average Hourly Earnings, which are often more critical, also came out below predictions at 0.1% MoM and 2.6% YoY. A mean reversion is a forecast now with 0.2% MoM and 2.7% YoY. Wage growth has only very modestly increased in the past few months and remains the missing component. According to the economic textbook, an economy at full employment should see wage pressures. So far, each time wages rose, there was no momentum in the following month. More money in Americans’ salaries is key to higher core inflation. The unemployment rate stood at 3.9% in April, yet it is important to note that the participation rate is still below pre-crisis levels and the Fed is aware of the slack in the US economy.

The last word of the week belongs to the ISM Manufacturing PMI. The forward-looking indicator usually serves as one of the hints toward the NFP but is released 90 minutes after it this time. Apart from the headline, watch out for the Prices PAid component which reflects inflation that the Fed eyes. In case the NFP comes out within expectations, a surprise in this number could have a more significant impact on the close.

Here are the top US events as they appear on the forex calendar:

Japan: Safe haven is back

The Japanese calendar is lighter as we turn the page into June. Japan will likely continue enjoying a very low unemployment rate once again after it hit 2.5% in March. The jobs to applicants ratio remain elevated at 1.59. Trade figures were mixed in March and April’s figures may be slightly better.

The Yen is expected to continue reflecting fear. After the Trump-Kim Summit was canceled, any further exchanges between the countries could result in movements in the Japanese currency. Ongoing talks to ease tensions and continue the peace process could weigh on the Japanese currency while an exchange of insults and threats could push it higher.

Developments in global trade and especially trade between China and the US will also play a role. US Commerce Secretary Wilbur Ross is planned to visit China from June 2nd, but reports about preparatory talks could come out during the week. Talk about removing tariffs or concessions by both sides could send the Yen lower while fresh duties and threats of those could send investors to the arms of the Yen.

The ramifications of Trump’s abandonment of the Iran deal have not been fully realized. They cause tensions between the European Union and the US over secondary sanctions that hurt European companies doing business in Iran. The story may come to the limelight and so could any potential flare-up in the Middle East.

Here are the events lined up in Japan:

USD/JPY Technical Analysis – Broken channel

The technical picture has significantly worsened for the USD/JPY. The RSI is now close to 50 after standing at high ground close to 70 but below that level, indicating further gains. Things are more balanced now. Momentum is not going anywhere fast either.

More importantly, the pair broke below the uptrend support line (thick black lines on the chart) and also slipped under the 200-day Simple Moving Average which is just above 110.00.

The fresh low around 108.95 is the initial support line. It is closely followed by 108.60 which was a stubborn support line in early May. The 50-day Simple Moving Average awaits at 108.50 and is followed on the other side by 107.90 which was a swing high back in mid-April.

109.50, which capped the pair on its way up, is now a battleground. The round number of 110.00 remains significant and is closely backed up by the SMA 200 mentioned earlier. Higher, 110.50 was a swing high early in the year, and 111.40 was the peak on May 21st.

What’s next for USD/JPY?

Last week we discussed a potential upswing unless we get unpleasant news that indeed came. It is hard to assess whether the upcoming week will feature good or bad news, but it is possible to see that the reaction function to US data has changed. We may see the yen strengthening on upbeat US data as Emerging Markets jitters trigger safe-haven flows. So, good US data may weigh on the pair, and we could see further falls.

The FXStreet FX Poll provides additional interesting insights.

More: USD/JPY breaks below uptrend support on Trump’s call-off of the Summit with Kim – levels

-636628359287405863.png)